Know Your Customer (KYC) refers to the process of verifying the identity of your customers, Ultimate Beneficial Owners (UBOs) and third-party businesses during onboarding and throughout the customer journey. The KYC process typically includes the identity verification practices used by regulated bank customers to assess and monitor customer risk. KYC verification is a legal requirement for anti-money laundering (AML) measures.

Jumio enables financial institutions to fulfill KYC requirements with accurate, real-time online ID and digital identity verification. Our solutions have helped banks and other financial institutions replace slow, ineffective and manual KYC processes with more automated solutions that can be embedded within the online account setup and onboarding experience.

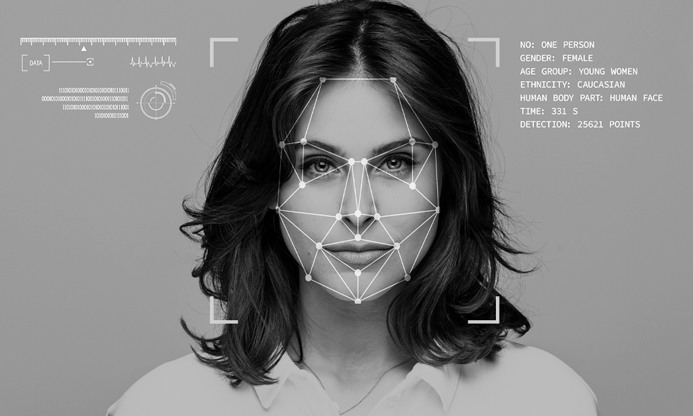

Jumio's AI-powered end-to-end identity verification and authentication solutions deliver key benefits to organizations striving to maximize onboarding and meet KYC and AML regulations.

Easily service your global client base and meet compliance mandates in multiple jurisdictions. Jumio supports over 5,000 identity document types in over 200 countries and territories.

With a cross-device verification process, you can easily verify your customer’s identity across platforms including mobile, web and API.

Streamline the customer experience and save time and money with a simple onboarding process for new customers.

Instant feedback helps users take a high-quality scan and selfie on the first try, minimizing frustration and abandonment.