Jumio Global Consumer Research

Conducted by Censuswide, the Jumio 2023 Online Identity Study reveals an understanding among consumers around how generative AI and deepfake technologies could accelerate identity fraud, and the subsequent need for digital identities for online verification and authentication.

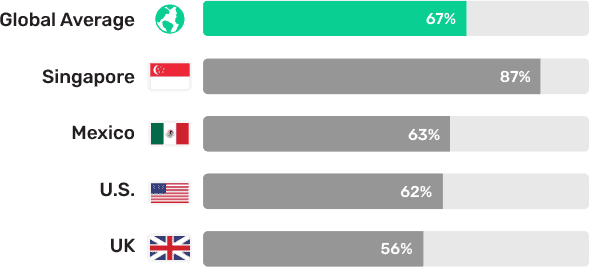

Over two thirds (67%) of consumers say they are aware of generative AI tools – such as ChatGPT, DALL-E and Lensa AI – which can produce fabricated content, including videos, images and audio.

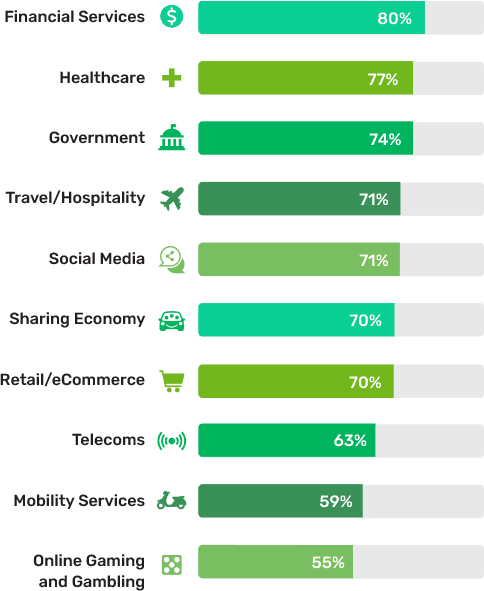

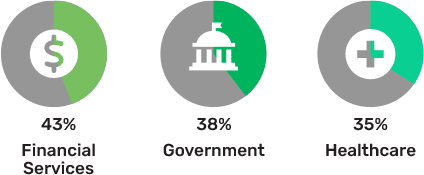

Awareness of deepfake and generative AI technologies:

Stuart Wells

Chief Technology Officer

Jumio

![]()

Online organizations must look to implement multimodal, biometric-based verification systems that can detect deepfakes and prevent stolen personal information from being used. Encouragingly, our research indicated strong consumer appetite for this form of identity verification, which businesses should act on fast.”

Philipp Pointner

Chief of Digital Identity

Jumio

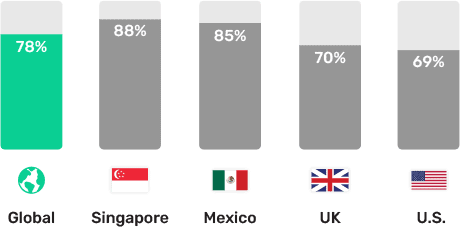

Consumers are willing to spend a little or a lot more time on identity verification if it improves security.

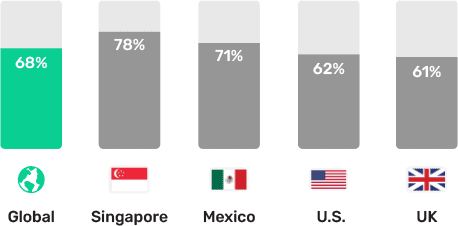

Consumers are willing to have a digital identity like a government-issued electronic driver’s license or e-passport, and are already using their digital identity to access online accounts and perform identity verification.

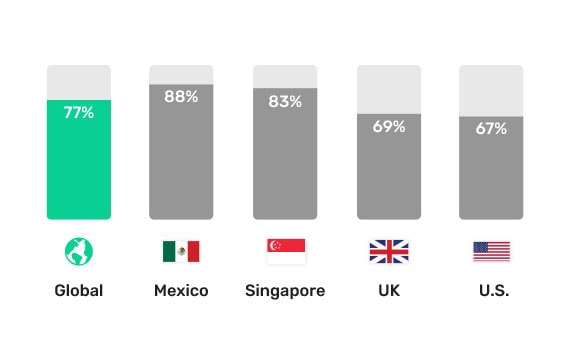

77% of global consumers say robust identity verification would help prevent underage access to online gaming/gambling.

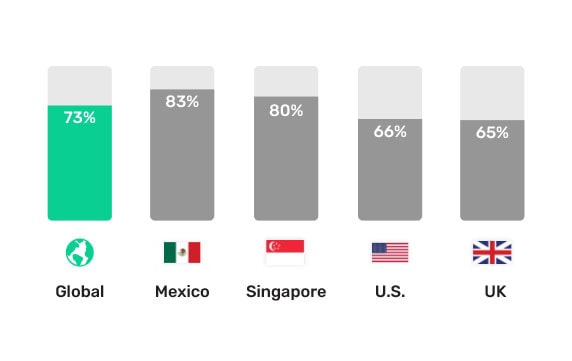

73% of global consumers say robust identity verification would help prevent underage access to social media.

Providing a photo of a valid ID document and a selfie to prove the person setting up the account is who they claim to be and that they meet minimum age requirements.

*All data points presented on this page reflect net figures unless indicated with an asterisk (*).

Online Identity Study: Why is fraud becoming harder to spot?

Watch Now

Global Summary Findings [English]

Global Summary Findings [Spanish]

Awareness of deepfake and generative AI [English]

Awareness of deepfake and generative AI [Spanish]

Sentiments about generative AI and online identity theft [English]

Sentiments about generative AI and online identity theft [Spanish]

Openness to digital identities for identity verification [English]

Openness to digital identities for identity verification [Spanish]

Global Survey Suggests Consumers Overestimate their Ability to Detect Deepfakes

Encuesta global sugiere que los consumidores sobrevaloran su capacidad para detectar las deepfakes