A staggering $26 billion in fines has been imposed for non-compliance with Anti-Money Laundering (AML), Know Your Customer (KYC) and sanctions regulations in the last decade, according to recent Fenergo analysis.

All 10 of Europe’s biggest banks, including BNP Paribas, Société Générale, Santander and other popular banks have fallen foul of anti-money laundering authorities. Recent crises at the likes of ING, Danske Bank and Deutsche Bank only reinforce this impression, demonstrating how no bank is immune to money laundering sanctions, no matter how large. In fact, at least 18 of the 20 biggest banks in Europe, including five UK institutions, have been fined for offenses relating to money laundering since the financial crisis. Many of these infractions occurred within the last few years, an indication of how widespread money laundering has become.

But this isn’t just a European concern. The U.S. Department of Justice is the most punitive regulator in the world when it comes to imposing financial penalties for noncompliance, levying half of the global AML/sanctions fines amount — nearly $14 billion. The New York Department of Financial Services comes in second, with $3.6 billion. Adding insult to injury, U.S. regulators have hit foreign banks hard, imposing fines on European banks nearly five times the amount imposed against U.S. banks, according to Fenergo.

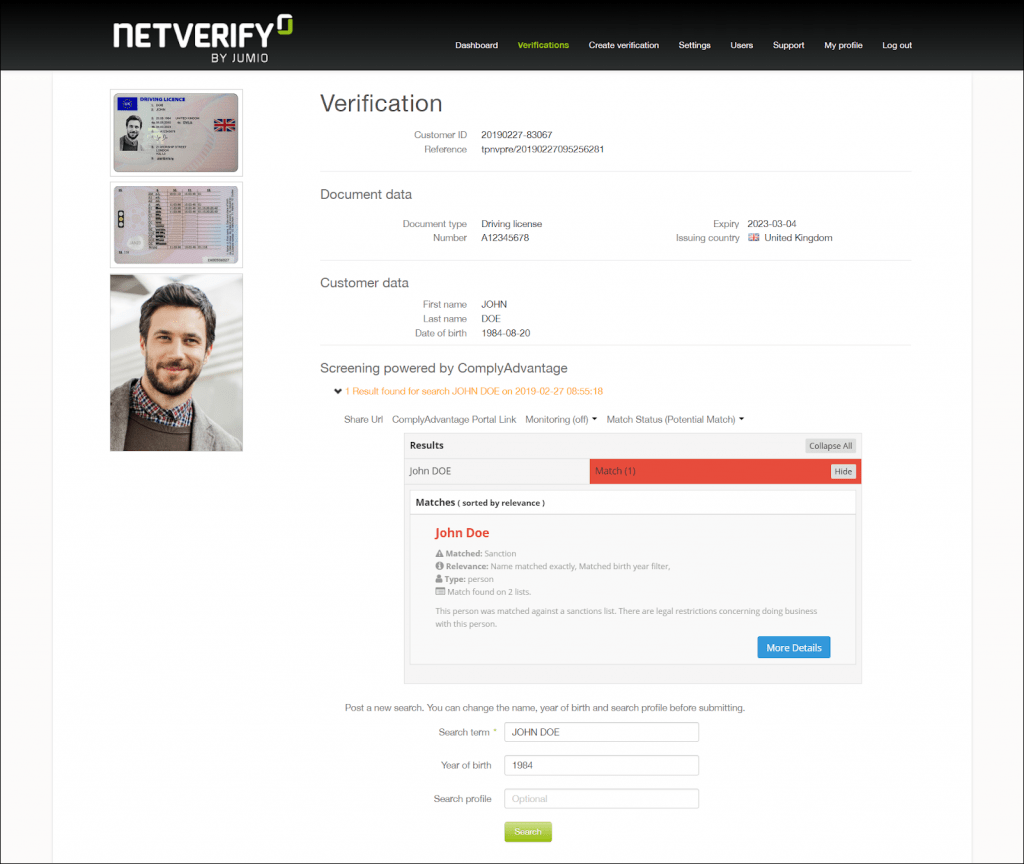

With that backdrop, we’re announcing the launch of Jumio Screening — a fully automated AML screening solution that integrates ComplyAdvantage, a dynamic real-time database of people and companies that pose financial crime risk. The partnership provides significant advantages to our financial service customers (and any company who wants to mitigate financial crime risk), giving them access to a global proprietary database of structured risk profiles covering enhanced sanctions, regulatory and enforcement watchlists, politically exposed persons (PEPs) and adverse media.

This new product integration automatically flags any new online customers when they are initially onboarded (or enrolled) if their names are listed within any of these databases. It allows us to instantly check profiles of your customers on global and national sanctions lists including OFAC, HMT, UN and thousands of other government, regulatory, law enforcement, fitness & probity watchlists, and adverse media for financial and other crimes. Perhaps, more fundamentally, this joint solution enables our compliant-conscious customers to benefit from best-of-breed identity verification and AML screening in a single solution that can dramatically reduce false positives and the excessive manual reviews that they trigger.

Customers can now leverage a single Jumio dashboard for best-of-breed identity verification and watchlist, sanctions, PEPs and adverse media screening. Jumio’s identity verification detail page will immediately alert your compliance team if there’s a hit within any of these databases.

Full Lifecycle AML Monitoring

Integrating AML screening at customer onboarding is an important ingredient, but is not sufficient for a more holistic, complete AML due diligence program.

New customer screening is used to identify customers and is critical for identifying sanctions, PEPs and other-high risk targets entering an organization or having financial dealings with it. But, this is just the tip of the AML screening iceberg.

Financial institutions need to monitor for suspicious activity and spot patterns that may be indicative of money laundering, financial crimes, corruption, drug trafficking or other criminal activity. Indeed, a transaction involving the leader of a drug cartel is much more likely to be suspicious than a transaction involving a “round amount” (e.g., €10,000).

While it still falls on banks and financial institutions to implement their own transaction monitoring protocols to flag risky transactions, Jumio can help with AML compliance by integrating ongoing monitoring of existing customers to flag any customers who get added to these sanctions and watchlists.

Ongoing monitoring checks happen/occur through ComplyAdvantage’s proprietary databases as well as through thousands of subscribed and global news sources to see if an existing customer gets added to any of these lists. If there’s a hit, customers are notified immediately via an alert so they can mitigate risk and take appropriate next steps. This ensures that your business is kept informed of any status changes to your existing customer base in real time. And like the onboarding screening process, ongoing monitoring service can be tailored via flexible configuration options, search profiles and filters to each customer’s individual risk configuration and help reduce time-consuming false positives.

Automatic AML screening and ongoing monitoring, coupled with KYC-compliant identity verification, is a smart and economical way to identify and minimize potential risks which could affect your reputation and integrity.

We encourage you to learn more at www.jumio.com/screening.