Traditional and Challenger Banks Need to Rethink Onboarding

How Jumio Benefits the Banking Industry

Identity Verification

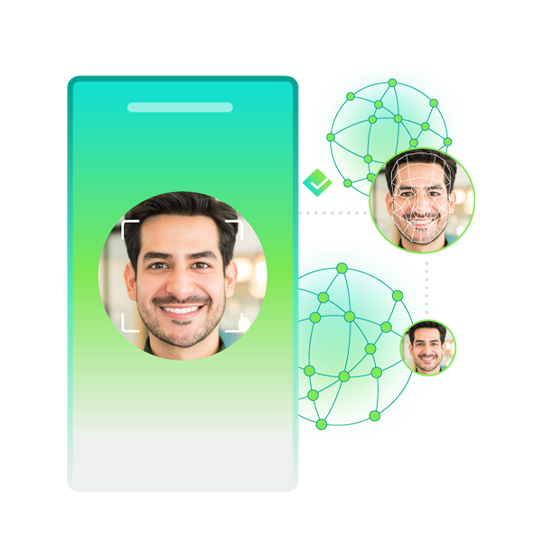

Liveness Detection

Fraud Deterrence

Ongoing Authentication

4 Ways to Streamline the Onboarding Process

Increased Conversions

Nearly 40% of potential new accounts are sacrificed during the onboarding process because of time-consuming, clunky processes.

- More ID Types

Support more than 5,000 ID subtypes around the globe including driver’s licenses, passports and ID cards. - More Channels

Onboard customers via mobile SDK, webcam and API to cast a wider net, across a range of demographics. - More Chances

Deliver specific reason codes for why a given ID or selfie was rejected so users can course-correct and continue with their application.

Dramatically Faster Verification

Today’s banking customers expect an Uberlike experience with the ability to create online accounts in minutes, not days — anytime, anywhere.

- Less Verification Time

Reduce onboarding time from hours to less than a minute. - Less Manual Review

Leverages informed AI and a proprietary mix of technologies to deliver a definitive yes/no decision — lessening the need for time-consuming in-house manual reviews. - Less Fraud

Better protect your ecosystem against fraud and account takeovers than traditional methods of identity verification and authentication.

Bank-Grade Security

Given the type of information being captured during the identity verification process and the compliance fines associated with mishandling customer data, bank-grade security is a must-have.

- Secure Standards

Sleep easier knowing that Jumio’s been audited by industry leaders such as Deloitte, KPMG and EY in addition to numerous Tier 1 global banks and third-party regulators. - Secure Encryption

Encrypt all personal data in transit via TLS encryption using strong cipher suites and at rest with military-grade 256-bit AES encryption. - Secure Compliance

Comply with KYC, AML, GDPR, CCPA and PCI-DSS by meeting their rigorous standards for security and data privacy.

Compliance Simplified

North American financial institutions spent US$3.4 billion in 2019 on technology for AML-KYC compliance (Celent). But, unfortunately, onerous user experiences and long wait times are still the norm.

- Complete Checks

Replace slow, ineffective and manual KYC processes with more automated solutions that can be embedded within the online account setup and onboarding experience. - Complete Compliance

Rapid online identity verification helps your organization manage and ensure compliance including AML, KYC, GDPR and CCPA. - Complete Coverage

Compliantly verify customers across the globe, in more than 200 countries and territories and in a multitude of languages, with over 5,000 ID document types.

Ready to see how Jumio can improve your onboarding?

Trusted by leading brands worldwide.

Waleed AlJasmi, Head of Digital Channels, Ahli United Bank