Filter by

Most Recent

- Most Recent

- Most popular

All time

- All time

- This Month

- This Year

‘Tis the Season for Travel Fraud: Protecting Your Customers During the Holidays and Beyond

After a massive decline during the COVID-19 pandemic, travel came soaring back in 2022. But while this rebound is good news for the travel industry, fraud has also been taking off. Criminals have realized that travelers provide a gold mine of value, both in the ease of stealing their identities (made easier because travelers must…

PEP Screening: Why it Matters and How to Optimize Your Process

When it comes to preventing money laundering and terrorist financing, financial institutions and large corporations have a crucial role to play. One important step in this process is screening politically exposed persons (PEPs) — individuals who hold a prominent public position or have close ties to such individuals — for potential risk. PEPs are considered…

KYC and AML Programs: How Do They Work Together?

When it comes to compliance, there are many different regulations for companies to navigate. Adding to the confusion is the various compliance terminology, such as AML and KYC, which are similar but can mean different things. AML or anti-money laundering refers to the steps that financial institutions and other firms must take to prevent criminals…

Trust and Safety: The Linchpin to Sharing Economy Success

How safe do you need to feel in order to rent a room in a stranger’s home, or to trust someone you’ve never met to drive you home after a night out on the town? Companies who get trust and safety right are reaping the rewards — the sharing industry is expected to skyrocket to…

What Does CDD (Customer Due Diligence) Mean for Banks and Financial Companies?

You wouldn’t hire a new employee without making sure they’re the right fit for the job, right? Just as employers thoroughly vet candidates, organizations across the financial services industry need to have a good read on their prospective clients before allowing them to open an account to mitigate fraud and money laundering risk. This is…

Using Workflows to Prevent Identity Fraud in User Onboarding and Beyond

When implementing a fraud-prevention system, there are multiple approaches you can take. The most important step is to keep fraudsters off your platform in the first place. Using identity verification and authentication, you can ensure the person who’s onboarding or signing in to an existing account is who they say they are. But stopping identity…

Groundbreaking New Fraud Prevention Technology for a Rapidly Evolving Fraud Landscape

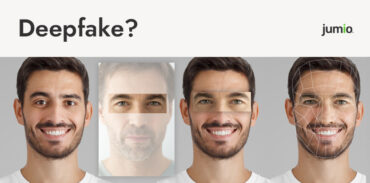

There’s an alarming trend in organized crime rings that has the potential to defraud businesses of billions of dollars in the next few years. Because of rapid advances in technology, crime rings have discovered they can attack a series of businesses in rapid succession and walk away with huge amounts of money or create hundreds…

How to Establish and Maintain Trust in the Sharing Economy

From car sharing services to short-term home rental services, the sharing economy is exploding. According to Industry Research, the sharing economy market is expected to grow at a CAGR of 32.01%, reaching $794 million by 2028. But the rise of the sharing economy has coincided with a rise in AI-generated deepfakes and other types of…

Bank With Your Smile: How Jumio Helps Credit Unions Fight Fraud

Jumio is on a mission to help credit unions fight fraud. Many credit unions are worried about implementing a new system that might disrupt their current members’ experience. At the same time, they know they have to take a proactive approach to fighting fraud, because waiting too long could jeopardize their brand and ultimately lose…

The Changing Face of Identity Verification

As businesses continue to expand their online offerings — and fraudsters become more and more sophisticated — it’s essential to be able to quickly and accurately establish the real-world identity of each person. According to the 2023 Gartner® Market Guide for Identity Verification, “The purpose of identity verification is to establish confidence in the identity…

How Biometric Security is Changing the Healthcare Industry

Advanced technology has been transforming the healthcare industry for decades, and meaningful changes have been made in how patients receive care and communicate with care teams. But little attention was given to healthcare operations and data security, creating opportunities for fraud, data leaks and workflow inefficiencies. The latest in biometric security technology is changing that….

Fighting the Specter of Fraud in Higher Education

Halloween may be weeks away, but the ghosts are out early this year — ghost students, that is. Ghost students are bots created by fraudsters that take advantage of online college application systems in order to receive financial aid and grant money. Using stolen or synthetic identities, they apply at colleges, register for classes and…