There’s an alarming trend in organized crime rings that has the potential to defraud businesses of billions of dollars in the next few years. Because of rapid advances in technology, crime rings have discovered they can attack a series of businesses in rapid succession and walk away with huge amounts of money or create hundreds of accounts for money laundering purposes before they are discovered. If businesses don’t evolve faster than the criminals, they are left vulnerable to massive losses.

That’s why a major shift is happening in the fight against fraud and financial crime. Jumio transformed identity verification many years ago by inventing selfie-based identification, and now Jumio is once again ushering in a groundbreaking new approach.

Introducing Jumio 360° Fraud Analytics

Jumio 360° Fraud Analytics uses AI-driven predictive analytics to identify fraud patterns across our cross-enterprise network and accurately predict the likelihood of fraud whenever a user goes through our ID verification process.

This approach goes beyond assessing the user’s ID and selfie and now adds sophisticated behavioral analytics to determine how each identity transaction fits within our vast network. This makes it simple to spot much more complex connections and is especially effective at detecting fraud rings and preventing fraud.

For example, has this person been onboarding at several banks lately or submitted a document that has been used elsewhere for fraud? They might be a part of a fraud ring or simply the victim of identity theft. Are they a legitimate customer who is suddenly connected to a known financial criminal? They might have been scammed into unwittingly laundering money. Was the identity behind the user manufactured in any way? They might have created a synthetic identity — or someone has created a synthetic identity based on their information.

Rather than just looking back to see where fraud has already happened, this approach can stop fraud before it happens — automatically. Let’s take a closer look at how this works.

It Starts with Data

Accurately identifying fraud patterns requires a massive amount of data. Jumio has processed over one billion transactions and analyzes billions of data points, so our machine learning and AI grow smarter and more insightful every day. Armed with this vast data set and highly trained automation, Jumio is best positioned to protect our customers from rapidly evolving fraud threats.

Identify Complex Patterns

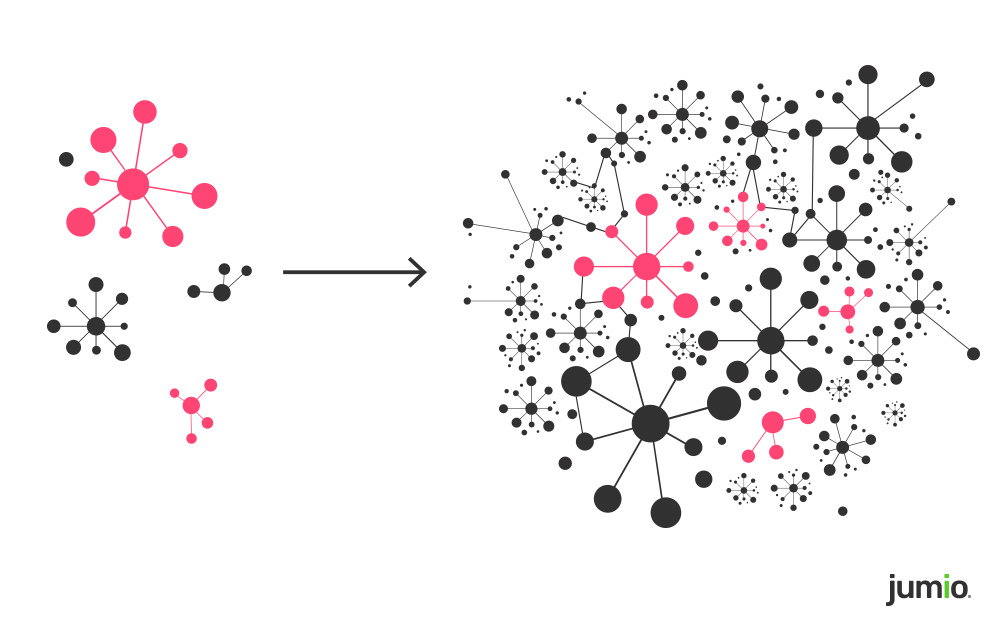

We conducted studies that showed 25% of transactions had connectivity with other transactions, and most of the fraud we discovered was within this connected population. This indicates that most fraud is repetitive and connected in nature.

But simple linkages don’t tell the whole story. Jumio’s sophisticated AI identifies fraud patterns across our entire network. Our machine learning models analyze billions of data points to spot behavioral similarities and determine which of those similarities indicate real fraud instead of coincidental connections. For example, has the same ID been used by multiple people? Or was it the same person each time with unintentional variations in the spelling of their name?

We then classify identity transactions into clusters and determine the fraud risk of each cluster. This approach provides a true 360-degree view of fraud across our vast network.

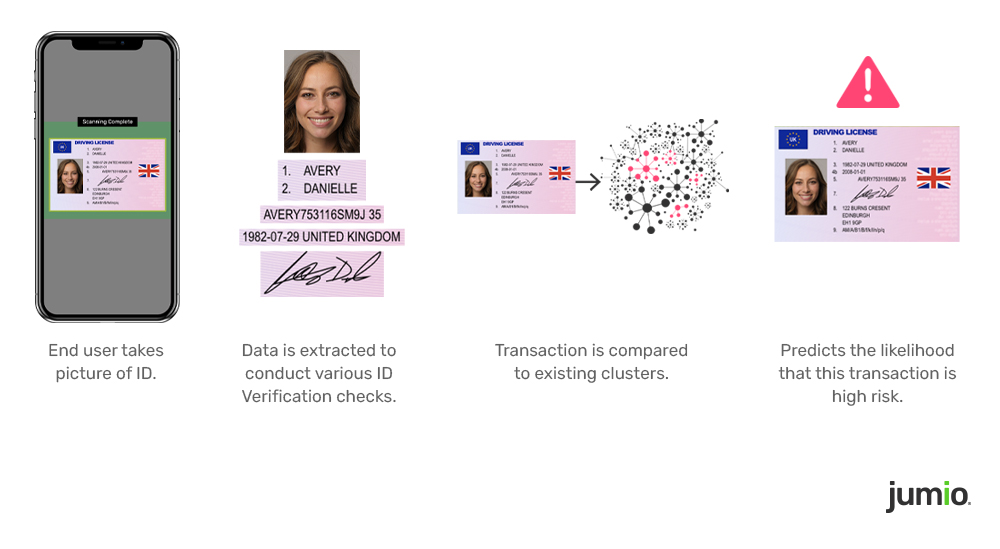

Assess Fraud Risk of Each New Customer

Each time one of your customers goes through our ID verification process, Jumio continues to perform a variety of checks to ensure the ID is authentic and valid. We then use AI-driven predictive analytics to determine the likelihood that this person is a fraudster with far more accuracy than just evaluating the ID on its own.

We use graph database technology plus a layer of machine learning intelligence to look beyond simple associations and create a much richer, multi-dimensional picture by comparing this identity transaction and its data to the clusters across our network. Finally, we run a series of quality checks and use connected-data AI to deeply understand the connection of this transaction to the clusters and the rest of the network.

Make Smarter, AI-driven Decisions

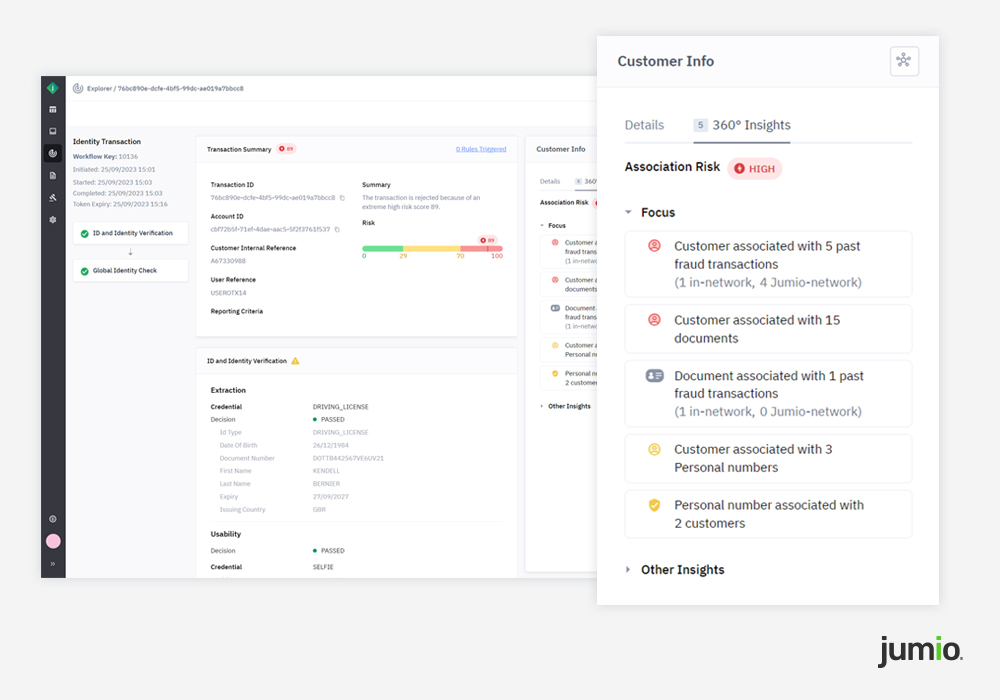

The outcome is a predictive score that forecasts the likelihood that this identity transaction is fraud, with a very high level of accuracy. Jumio can reject identity transactions whose score is above a certain threshold, allowing you to stop fraudsters at the front door — automatically.

You can set the score threshold to match your company’s unique requirements, allowing you to automate smarter decisions tailored to your business. Even when set to a conservative threshold, our initial studies show that this approach improves our existing, highly accurate fraud detection by 30% without increasing the false rejection rate.

Access Insights To Stay Informed

- Transparency and explainability are critical for auditing automated decisions. Our easy-to-use dashboard gives you insights into the reasons why the predictive analytics rejected each identity transaction. For example, the reasons might indicate:

- The individual is connected to the same document (such as a U.S. passport) with two different numbers

- The confidence is high that those numbers were in fact different

- The cluster this individual is associated with has a high incidence of fraud

- This person submitted a high number of transactions recently across the network

In addition to viewing insights in the dashboard, you can access the score and insights programmatically through our APIs. This allows you to ingest them into your own decisioning and machine learning models if desired.

For all identity transactions, a label shows you at a glance whether the transaction was generally considered low, medium, or high risk based on the predictive score. This score also feeds into the overall risk score, which aggregates scores from a multitude of fraud checks and risk signals across the Jumio platform.

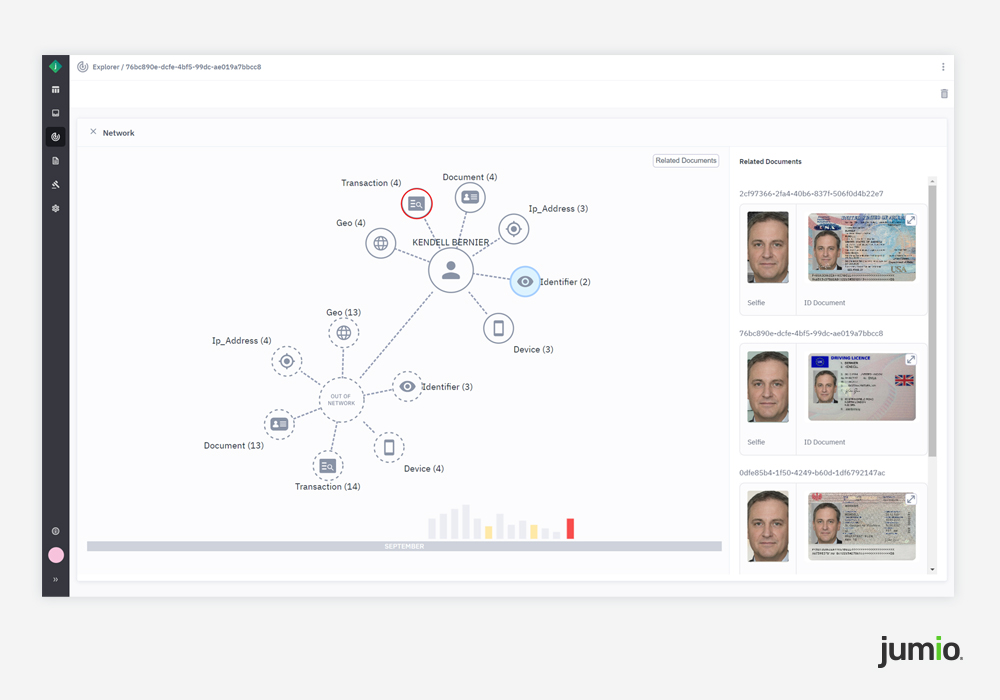

We also provide a visual representation of the high-level linkages we identified. While the depth and breadth of connection data in the clusters is much greater than what is shown here, this tool can help you understand how people, documents, devices and more are connected.

Jumio takes a privacy-first approach to leveraging these insights. You can see details for your own users, but you cannot access the names and information of users from other companies, and they cannot access the data from yours. Jumio simply analyzes data across all our customers to drive much more sophisticated fraud detection. If one of your users is connected to a fraudster in another customer’s ecosystem, you can see that your user is connected to a high-risk individual, but you cannot see details about that individual.

Summary

Jumio 360° Fraud Analytics is essential for protecting companies and consumers against fraudsters in the rapidly evolving fraud landscape. It complements our highly accurate ID + selfie identity verification with new predictive analytics that analyze data across our cross-customer ecosystem.

- Our vast identity transaction network lets us assess a person’s risk better than siloed, in-house decision making can.

- We can identify and stop sophisticated fraud patterns, such as fraud rings and other coordinated attacks.

- We enable faster, smarter, automated decisions.

These changes are paradigm shifts that are transforming the industry, and Jumio is leading the way with our AI-driven, connected-data intelligence. Our innovative solution leapfrogs other market players because of our exclusive data, expansive network and proprietary AI-driven technology.

Jumio 360° Fraud Analytics is currently available as a preview release for select customers and will be fully available in 2024. To learn more about how Jumio can help you keep fraudsters away from your platform, contact us today.