There’s no question that online gaming is hot. There’s a lot of money on the table — the global online gambling industry is expected to generate revenues of more than $74 billion by 2023.

Casumo launched in 2012 with a vision to disrupt the status quo in the online gaming industry. The company prides itself in being more than just an online casino and continuously focuses on creating and maintaining an exciting experience for its players, which can be a challenge. Why?

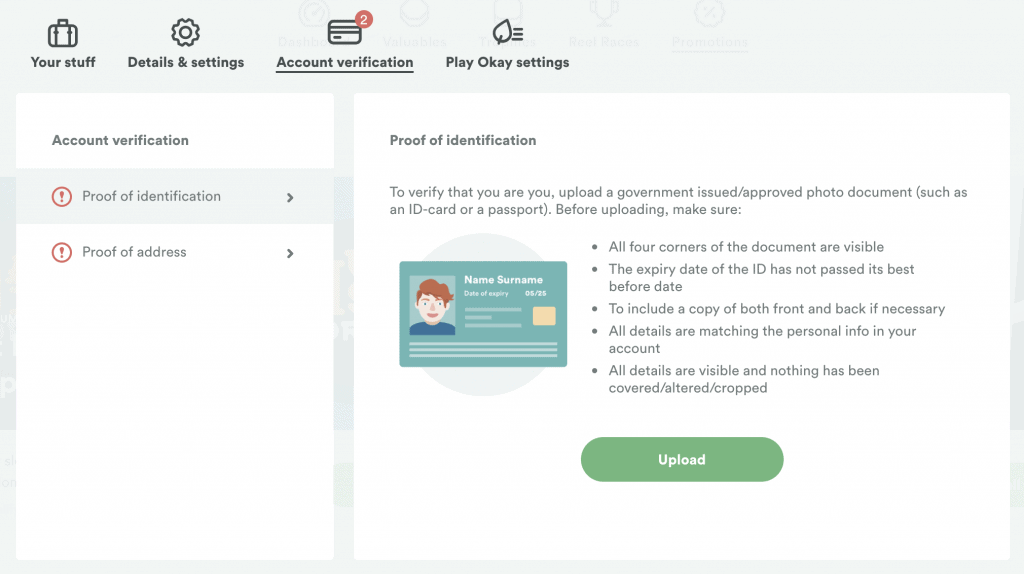

Online gaming is also a highly regulated industry, and online casinos like Casumo need to strike a balance between meeting compliance mandates and keeping access easy and the experience enjoyable for players.

Gaming regulations vary by jurisdiction, but one commonality is the need to meet stringent Know Your Customer (KYC) compliance regulations. Gaming operators need to verify the identity of players, verify their physical address (based on the address printed on their bank statement or utility bill) and verify their age (online gambling is legal provided the player’s minimum age is between 18 and 21 for the most part, depending on the country).

Casumo had long seen a need for a more seamless identity verification process. Handling document verification over email proved to be ineffective as the business grew. Casumo later built out internal KYC tools, but wanted to continue streamlining and expediting the process. This is where Jumio came into play.

Casumo’s key criteria for selecting a KYC-compliant solution was secure archiving of documents, solid technical support and an easy-to-understand front-end solution for the players. Jumio met these criteria and was endorsed by other gaming operators, which led Casumo management to select Jumio for its front-end KYC solution.

Jumio’s Netverify API uses a proprietary mix of artificial intelligence, augmented intelligence, computer vision and verification experts to determine if an identity document is authentic and belongs to the user. Netverify seamlessly integrates with Casumo’s existing workflows to determine — through a simple API call — if players are who they say they are, live within a legal jurisdiction and that they meet the minimum age requirement, and particularly at two key times: at point of deposit and at point of payout.

Jumio is working with Casumo on three key components of player verification:

- ID verification: The government-issued ID needs to be verified as valid

- Age verification: The age of the person possessing the ID needs to meet minimum age restrictions, which are not uniform and can vary by geographic jurisdiction.

- Address verification: Address verification lets Casumo know where its players are located in order to meet geographic jurisdiction requirements.

Since integrating Jumio into its workflow, Casumo has experienced more streamlined and efficient KYC processes and has increased its KYC handling capacity by 80 percent.

“Casumo’s internal KYC tools in combination with Jumio’s Netverify API have been a game changer for us in terms of streamlining our KYC processes both internally and externally,” says Jakub Mielczarek, Head of Payments, Fraud and AML at Casumo. “We’ve gone from an e-mail based KYC process to a process which is based on players uploading documents while logged into their user accounts. This results in increased security and a better foundation for player retention with easy verification.”

Read the entire Casumo case study here.