Jumio’s KYX Platform combines data from a variety of sources to build a complete digital profile and risk assessment of online users

Jumio, the leading provider of AI-powered end-to-end identity verification and eKYC solutions, today announced the launch of the Jumio KYX Platform, a unified platform that adapts to the unique needs and risks of organizations. The Jumio KYX Platform lets modern enterprises easily verify user identities for onboarding, safeguard existing accounts and mitigate financial crime risk.

The Jumio KYX Platform knocks down one of the biggest hurdles to digital transformation for many organizations — the identity verification and eKYC process. Whether it’s a customer, user, patient, employee, business partner or student, Jumio helps modern enterprises know, then trust the ‘X’ in their business. The platform enables organizations around the globe to manage compliance requirements, such as KYC, AML and GDPR, by providing a layered approach to identity proofing and corroboration.

“Digital transformation is more than a buzzword. It’s today’s business imperative. To succeed, organizations must transform quickly and do it in ways that build trust, security and satisfaction,“ said Robert Prigge, Jumio’s CEO. “Businesses can tailor the Jumio KYX Platform to fit their unique needs and risks and tap into services that accelerate digital transformation without sacrificing security and convenience.”

Three Layers to Jumio’s KYX Platform

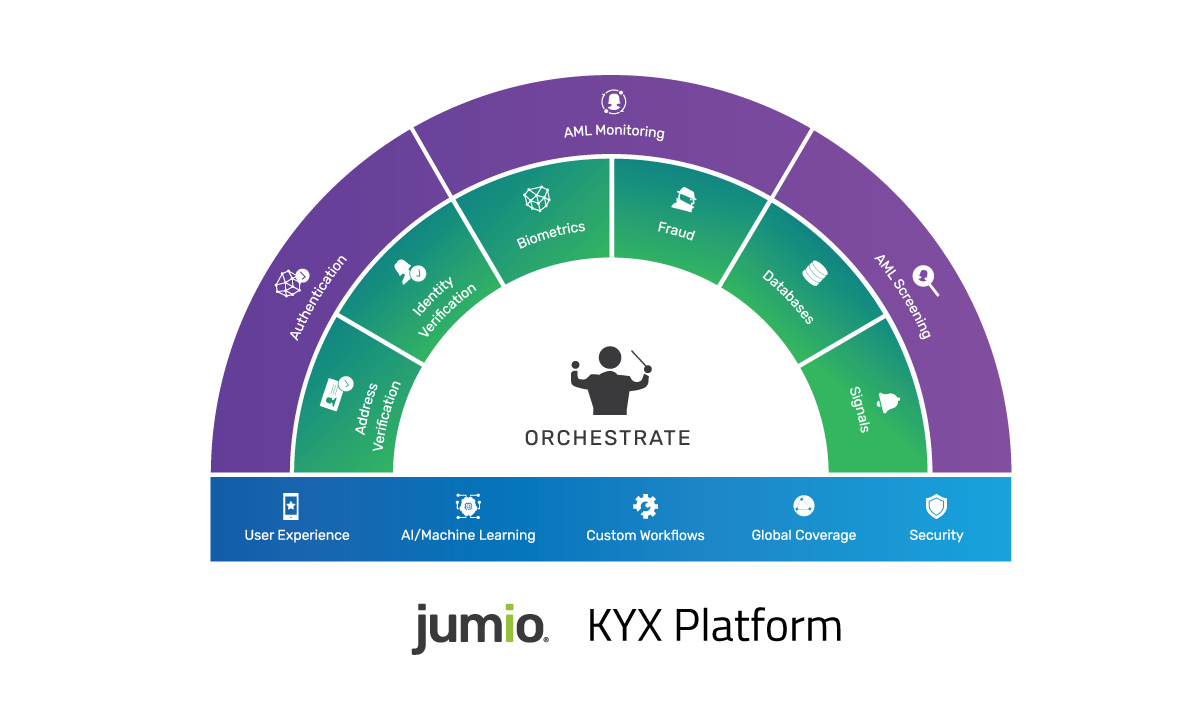

The Jumio KYX Platform includes three layers designed to establish, maintain and reassert trust with remote users.

The KYX Engine: The engine behind the Jumio KYX Platform includes a number of interwoven features, including an award-winning UX, state-of-the-art AI/ML, custom workflows, global coverage and bank-grade security.

Identity Proofing and Corroboration: Organizations can layer in a number of identity services to increase the level of identity assurance and answer the fundamental questions: is the user who they claim to be online and is it safe to start doing business with them? Because many organizations rely on more than one identity-proofing method, it’s increasingly imperative for enterprises to intelligently orchestrate across these different capabilities.

By 2023, 75% of organizations will be using a single vendor with strong identity orchestration capabilities and connections to many other third parties for identity proofing and affirmation, which is an increase from fewer than 15% today (source: 2020 Gartner Market Guide for Identity Proofing and Affirmation).

The KYX Platform includes these identity proofing services:

- Address Services: Validate and corroborate the user’s address with independent, third-party sources.

- Identity Verification: Automated and hybrid solutions for identity proofing that deliver the industry’s highest level of verification accuracy.

- Biometrics: Advanced liveness detection and face matching technologies for unsurpassed identity assurance and ease of use.

- Fraud: Dramatically reduce new account fraud with anomaly detection, blocklist checks and a required selfie.

- Databases: Automated database pings, including government watchlists, DMV and PEPS and sanctions help identify fraud and AML risks faster.

- Signals (coming soon): Jumio will be releasing new features in the coming months that provide incremental fraud signals to better assess new user risk.

Authentication and AML Monitoring: After the account has been created, Jumio offers a number of services designed to safeguard the account against account takeover and empower compliance teams to make better decisions faster and mitigate the threat of money laundering and other financial crimes.

It’s a common refrain that the COVID-19 era has accelerated digital transformation trends. According to a recent J.D. Power study, nearly one-third (31%) of new account openings are executed through a bank website or mobile app, up from 22% in 2019 — that’s a 50% increase in just one year. And this trend has only accelerated during the pandemic.

As more and more organizations have increasingly gone digital, there has been a parallel proliferation of cyberattacks that attempt to damage, disrupt or gain unauthorized access to the computer systems of banks and other financial institutions. So while banks and other enterprises are looking for ways to streamline the onboarding process, they must ensure that they build in the necessary safeguards to protect their ecosystems, reputation and accounts owners.

With the Jumio KYX Platform, growing companies can tap into Jumio’s rich expertise and create a highly customized onboarding and eKYC experience based on their unique use cases, risk appetite and budget.

For more information on the Jumio KYX Platform, please visit jumio.com/kyx.

About Jumio

When identity matters, trust Jumio. Jumio’s mission is to make the internet a safer place by protecting the ecosystems of businesses through a unified, end-to-end identity verification and eKYC platform. The Jumio KYX Platform offers a range of identity proofing services to accurately establish, maintain and reassert trust from account opening to ongoing transaction monitoring.

Leveraging advanced technology including AI, biometrics, machine learning, liveness detection and automation, Jumio helps organizations fight fraud, onboard good customers faster and meet regulatory compliance including KYC, AML and GDPR. Jumio has verified more than 250 million identities issued by over 200 countries and territories from real-time web and mobile transactions. Jumio’s solutions are used by leading companies in the financial services, sharing economy, digital currency, retail, travel and online gaming sectors. Based in Palo Alto, Jumio operates globally with offices in North America, Latin America, Europe and Asia Pacific and has been the recipient of numerous awards for innovation. For more information, please visit www.jumio.com.

Media Contacts

U.S. Media Contact

Alex Mercurio

10Fold Communications

[email protected]

949-940-5656

Europe Media Contact

Gemma Lingham

FleishmanHillard Fishburn

[email protected]

+44-208-618-2812