COVID-19 has had a huge impact on online customer adoption and, according to McKinsey Digital, “the rapid migration to digital technologies driven by the pandemic will continue into the recovery.”

Organisations have had to rethink their customer onboarding processes in order to move their services fully online, meet KYC/AML mandates and deliver a better digital customer experience.

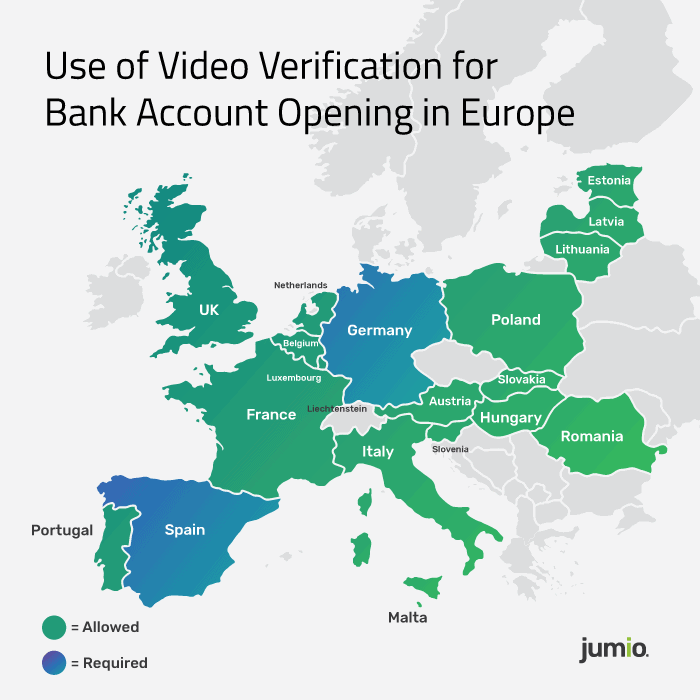

The COVID-19 recovery will undeniably be digital, but for banks, financial institutions and other regulated industries, online onboarding is subject to stringent KYC and AML requirements that vary widely depending on the geography of their customers.

In countries such as in Germany, Spain, India and Mexico, eKYC requirements specify the use of video verification technology where a two-way video conversation is hosted between the consumer and the financial institution and critical documents are captured as part of the digital verification process.

In other regions, where eKYC has long been accepted as a means of identity verification, and a choice of technology is acceptable, identity verification based on a biometric selfie might be a better choice.

Getting Know Your Customer right in any of those markets is a must for highly regulated industries such as financial services and gaming. With Jumio Video Verification, organisations can safely and securely onboard remote customers online with two-way video-based verification.

Jumio offers three modes of Video Verification:

- Assisted: Customers are identified through video assistance technology with dedicated or shared agents that interact in real-time via browser or mobile.

- Unassisted: Customers will independently capture a video of their identity documents, take a selfie and perform a liveness test without an online agent. Verification happens through a combination of AI and expert review.

- Platform Only: Customers are identified and verified through video assistance technology staffed by your own agents.

Here’s how it works:

- The customer shares their government-issued ID and a real-time selfie with a video agent or through the platform.

- Jumio checks the validity of the ID and the identity of the customer.

- Jumio Video Verification performs a liveness detection check (either by agent or platform) to determine if the customer is physically present and provides definitive verification results to our business customers to complete the onboarding process.

Video Verification offers numerous advantages:

- Streamlined user experience (without having to visit a branch office)

- Contactless customer onboarding

- Lower KYC costs with defensible audit trail and qualified preservation of recorded interviews

- Replaces outdated manual authentication processes

- Deters fraudsters and money launderers from creating accounts

Here are some of the regulators to look for when moving to an eKYC process:

- BAFIN (Bundesanstalt für Finanzdienstleistungsaufsicht) – Germany

- SEPBLAC (Servicio Ejecutivo de Prevención de Blanqueo de Capitales) – Spain

- BdP (Banco de Portugal) – Portugal

- CSSF (Commission de Surveillance du Secteur Financier) – Luxembourg

- FCIS (Financial Crime Investigation Service under the Ministry of Interior) – Lithuania

- FINMA (Swiss Financial Market Supervisory Authority) – Switzerland

- FKTK (Financial and Capital Markets Commission) – Latvia

- Finantsinspektsioon – Estonia

- CNBV (Comisión Nacional de Bienes y Valores) – Mexico

- RBI (Reserve Bank of India) – India

Whilst consumer protection is top of the agenda for these legislators, there has been a welcome move to allow user-friendly technologies to be built into the eKYC process.

For customers, there is no turning back. Traditional offline KYC, where a customer is required to visit a branch and bring ID documents and paperwork and wait for days to open an account might never be acceptable again.