Recently, we announced the release of Jumio’s next-generation Platform that provides companies with a true 360-degree view of their customers. In addition to displaying a yes/no decision during user onboarding, we now provide deeper insights that help you make more nuanced decisions about how to do business with each customer. This is essential for implementing a risk-based approach to compliance; if you rejected every customer who presented some risk, you’d be out of business.

A better approach is to set a tolerance of acceptable risk and initiate additional checks at certain points and thresholds that ensure you’re thoroughly vetting your higher-risk users without overburdening those who are low-risk. Let’s take a closer look at how this works.

Start with Frictionless Checks

During user onboarding, you can start with the most fundamental checks you want each customer to go through. For example, you might want to look at the device they’re using and the country where their IP address is located, since certain device attributes and geographies can immediately categorize some customers as higher-risk. You can check these risk signals automatically without any input from the user, so it’s a quick and frictionless way to start assessing their risk.

Managing Risk During Onboarding

How to Design Effective, Risk-Driven Onboarding Flows

Verify their Identity

Once they go through these initial checks, you will typically check identity attributes such as name, address, date of birth, phone, email and more against authoritative and non-authoritative databases to ensure that they do not pose a high enough risk that would immediately disqualify them as customers. If these checks classify the user as medium- or high-risk, you might then do a step-up identity verification by having them take a selfie and a picture of their identity document, such as a passport. This step helps to prevent fraud by ensuring the person is who they say they are. The sequence and logic around the above checks can also be customized using the no-code, drag-and-drop KYX orchestration engine.

Trigger Additional Checks if Needed

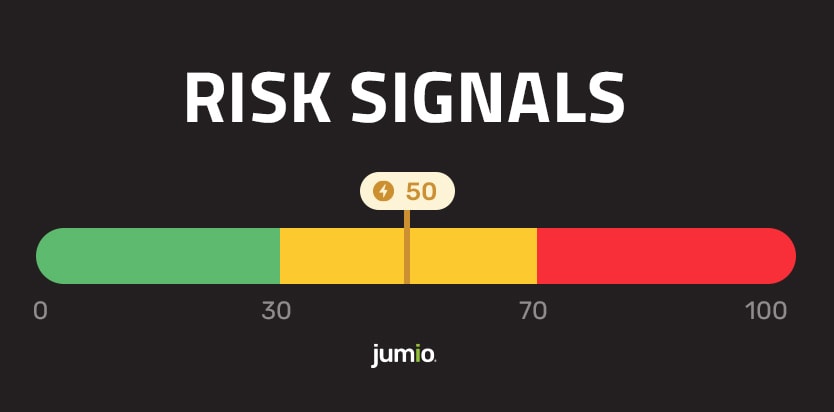

As your customer goes through each of these checks, the risk score is recalculated and updated, allowing you to make decisions along the way. For example, if they pass all these checks but have a risk score on the higher end of the spectrum, the logic in our orchestration engine allows you to perform additional checks such as submitting proof of address that your lower-risk customers won’t have to bother with. You might also call a government database check (such as a DMV check in the U.S.) to corroborate an ID against official records. As another example, if a customer is not on a sanctions list but is a politically exposed person (PEP), you can trigger additional AML screening and greater scrutiny of their transactions on an ongoing basis, whereas you might rescreen your lower-risk customers less frequently and with higher tolerances.

Use the Risk Score During Manual Intervention

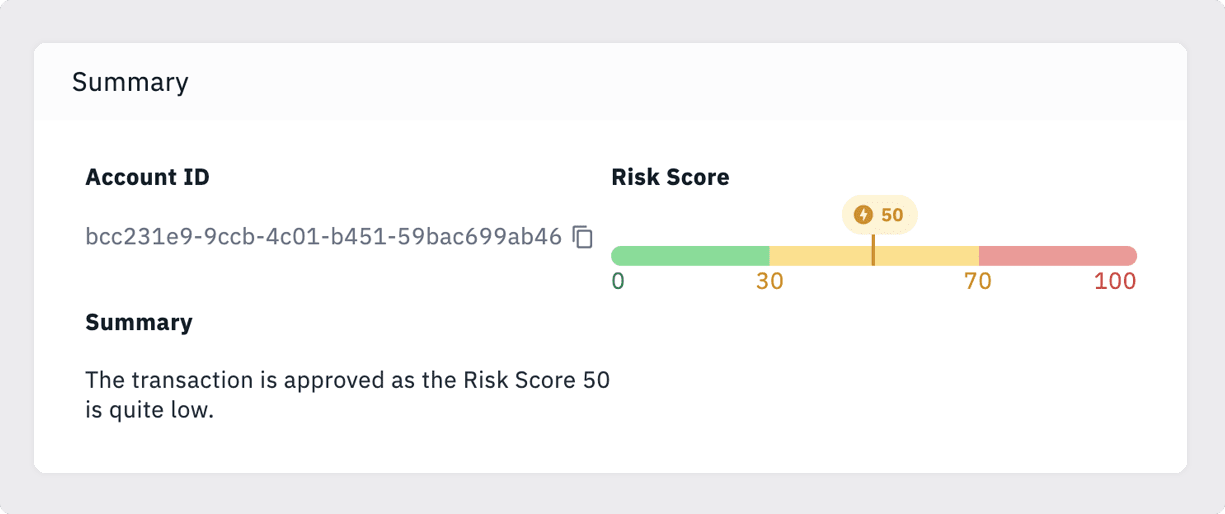

In addition to advanced functionality for automating this process, we’ve made it easier for your compliance team when manual intervention is required. The risk score is presented as a number and on a graph in an intuitive dashboard, which also includes reason codes to help you understand why a customer received that score. This enables your risk team to quickly and easily make informed decisions in real time.

Get Multiple Risk Signals within a Single Platform

Perhaps the most important aspect of the KYX Platform is that it seamlessly integrates with the top risk signal providers in the world, from both government and non-government data sources, allowing you to take advantage of the very best technologies from a single API layer and see a consolidated score. You no longer have to research, purchase, integrate and maintain solutions from multiple vendors. Jumio does all this work for you, both on the technology integration and business relationship side, to ensure you always have the latest and greatest risk signals with zero effort.

5 Key Qualities of a Successful AML Compliance Program

A Guide to Creating and Running Your AML Program

Jumio’s next-generation Platform has already made onboarding and compliance more advanced than ever before by giving you an end-to-end, 360-degree view of your customers during their entire journey with your company, from onboarding to ongoing monitoring. But this is only the beginning. We have a lot of exciting new features coming in 2022 that we look forward to sharing with you, including even more advanced orchestration with hundreds of data sources thanks to our acquisition of 4Stop.