Today, Jumio is announcing the launch of our KYX platform, which begs the question — what is KYX?

The “X” in KYX could be your customer, your patient, your business partner, your driver or any host of end users. We’re obviously riffing on KYC or Know Your Customer, which is the mandatory process of identifying and verifying the identity of a banking client when opening an account and rechecking periodically over time. Banks and other financial institutions, including credit card companies, insurance agencies, crypto exchanges and even online gaming sites are required to go through a number of identity proofing steps in order to ensure their customers are not involved with corruption, bribery or money laundering.

But the need for KYC-type identity proofing goes well beyond financial services. Whether it’s a customer, user, patient, employee, business partner or student, the Jumio KYX Platform helps modern enterprises know, then trust the “X” in their business.

Healthcare organizations need to know their patients so they can reliably deliver telemedicine and prevent prescription fraud. Gig economy companies often need to verify their drivers as well as customers as a matter of trust and safety. Online dating sites increasingly have to verify the identities and ages of their users in order to protect them from harm and online fraud. And even financial institutions want to “know your transactions” to ensure they’re taking every precaution to detect trends that may indicate money laundering.

In fact, it’s hard to think of any modern enterprise that isn’t seeking a higher assurance related to the identity of their online customers, given the sharp rise in new account fraud, identity theft and account takeovers.

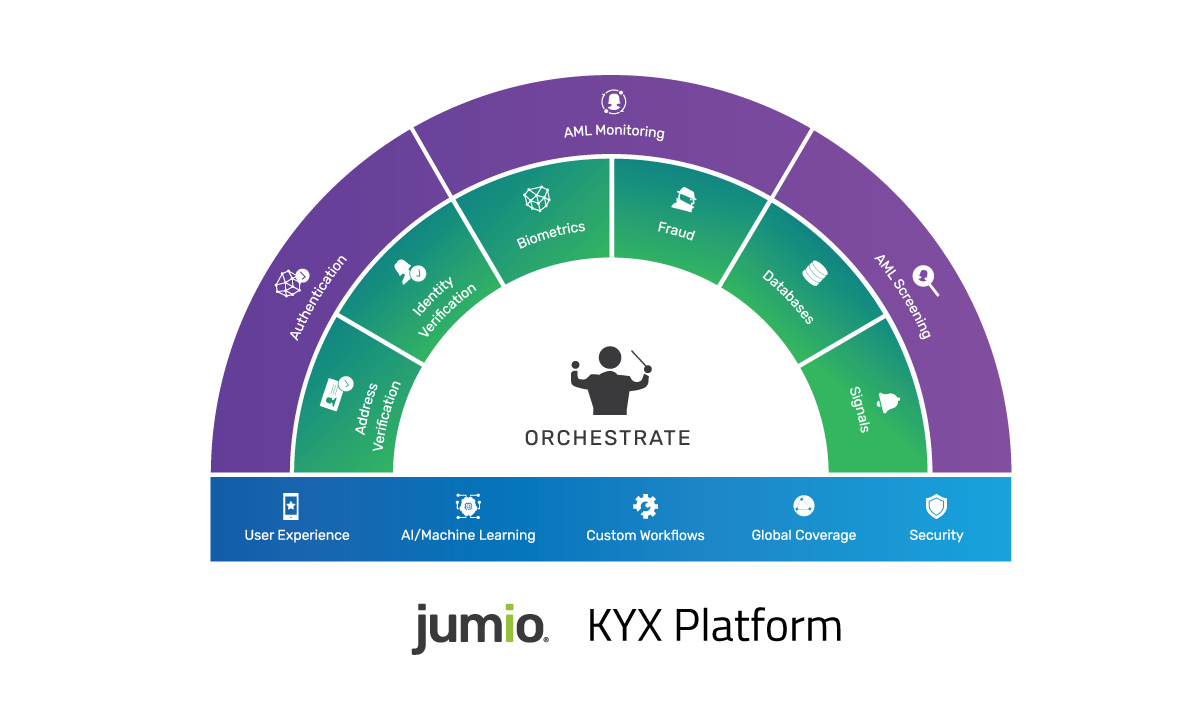

Three Layers to Jumio’s KYX Platform

The Jumio KYX Platform includes three layers designed to establish, maintain and reassert trust with remote users.

The KYX Engine: The engine (blue bar) is the foundation behind the Jumio KYX Platform and includes a number of interwoven features, including an award-winning UX, state-of-the-art AI/ML algorithms, custom workflows, global coverage and bank-grade security.

Identity Proofing and Corroboration: Instead of relying on a single identity proofing methodology, organizations can now layer in a number of identity services to increase their level of identity assurance. Because many organizations currently rely on more than one identity-proofing method, it’s increasingly imperative to intelligently orchestrate across these different capabilities.

By 2023, 75% of organizations will be using a single vendor with strong identity orchestration capabilities and connections to many other third parties for identity proofing and affirmation, which is an increase from fewer than 15% today (source: 2020 Gartner Market Guide for Identity Proofing and Affirmation).

The KYC Platform includes these identity proofing services:

- Address Services: Validate and corroborate the user’s address with independent, third-party sources.

- Identity Verification: Automated and hybrid solutions for identity proofing that deliver the industry’s highest level of verification accuracy.

- Biometrics: Advanced liveness detection and face matching technologies for unsurpassed identity assurance and ease of use.

- Fraud: Dramatically reduce new account fraud with anomaly detection, blocklist checks and a required selfie.

- Databases: Automated database pings, including government watchlists, DMV and PEPS and sanctions help identify fraud and AML risks faster.

- Signals (coming soon): Jumio will be releasing new features in the coming months that provide incremental fraud signals to better assess new user risk.

Authentication and AML Monitoring: After the account has been created, Jumio offers a number of services designed to safeguard the account against account takeover and empower compliance teams mitigate the threat of money laundering and other financial crimes.

What Makes the Jumio KYX Platform Different

Digital identity platforms have existed for years. In fact, Jumio is integrated into several of them. So, what makes Jumio’s KYX Platform different? Good question.

First off, most of the existing platforms are effectively aggregators of APIs and allow organizations to pick and choose which identity verification tactics and compliance checks to build into the onboarding or eKYC processes. They don’t have deep subject matter expertise into any of the individual eKYC/onboarding ingredients.

For Jumio, document-based identity verification has been our bread and butter for years as we’ve become the de facto market leader in this space. And this turns out to be a solid bet based on Gartner’s recent strategic market assumption that by 2022, 80% of organizations will be using document-centric identity proofing as part of their onboarding workflows, which is an increase from approximately 30% today (source: Gartner Market Guide for Identity Proofing and Affirmation).

Another key differentiator of our KYX Platform is that we can offer clean, curated integrations between the different layers, instead of messy third-party collections. By being a one-stop shop, organizations can pick and choose the order of operations and create an orchestrated workflow and a more holistic UX based on their specific use case, risk appetite and budget.

Many modern organizations now rely on more than one of the identity-proofing capabilities which makes orchestrating these different capabilities, across multiple vendors, a significant challenge. That’s precisely why we’re building the KYX Platform.

The Tailwinds of Change

There are several converging trends that are driving greater demand for a KYX Platform including:

- Data Breaches: Over the last two years, we’ve been inundated with news stories of large-scale data breaches where hundreds of millions of records, including name, email address, username, password and other personal information have been hacked.

- The Dark Web: Digital identities, including passports, driver’s licenses and ID cards, along with matching selfies, can be purchased on the dark web for just a few dollars. The anonymity of bitcoin and massive data breaches have led the dark web market to flourish.

- Regulatory Hurdles: The fines for non-compliance keep getting higher and higher. By the end of July 2020, global financial institution fines and penalties have totaled $5.6 billion for non-compliance with Anti-Money Laundering, Know your Customer and sanctions regulations. Fines issued by APAC regulators related to AML and KYC violations saw a dramatic increase from $3.5 million to almost $4 billion.

- Traditional Data-Centric Methods: The rampant theft of PII via large-scale data breaches continues unabated. Thanks to the dark web, criminals can attack static data verification methods and impersonate legitimate consumers to obtain their credit and public records, thus gathering a robust set of information to circumvent most data-centric verification tools.

- Digital Transformation: The COVID-19 pandemic has accelerated digital transformation, leading to a renewed focus on the digital onboarding process as a critical requirement for doing business.

It’s time to rethink identity verification from the ground up. It shouldn’t have to be a messy amalgamation of point solutions that need to be stitched together to provide a risk assessment of a new or existing user. Taking a platform approach to identity proofing and ongoing monitoring is quickly becoming a business imperative and one that can be addressed with a single solution.