Given the rise in branchless challenger banks and an increasing need for large incumbents to offer remote onboarding, online identity verification and eKYC are essential. Jumio’s unique combination of informed AI, computer vision and machine learning enables financial services firms to reliably and securely verify remote users while streamlining the onboarding process.

From banking to fintech, lending to payments, Jumio helps financial services companies screen out bad actors to meet regulatory obligations. Our screening solution checks against sanctions, politically exposed persons (PEPs) and adverse media watchlists — during onboarding and throughout the customer lifecycle.

Remote Onboarding

Simplify the new account onboarding process while avoiding the time and expense of validating every new customer in person.

Money Transfers and Payments

Provide a more secure digital platform for seamless financial transactions while meeting KYC/AML requirements.

Crowdfunding

Prevent fraud and account takeover in order to safeguard the experience for customers and investors.

High Risk Transactions

Prevent account takeover and safeguard your customers accounts with biometric authentication, which delivers significantly higher levels of digital assurance.

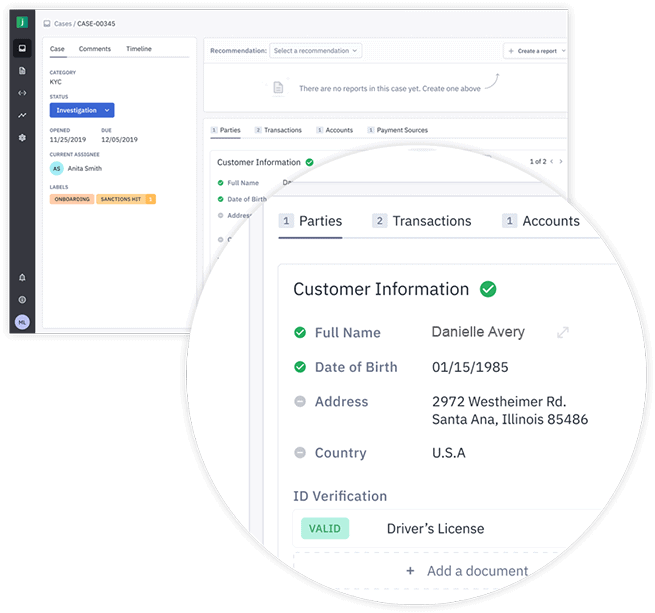

AML/KYC Compliance

Ensure regulatory compliance including Know Your Customer (KYC) and Anti-Money Laundering (AML) in real-time, as if your customer is standing in front of you.

Mortgage Applications

Remove friction from the mortgage application process by authenticating documents online and meeting KYC requirements.

Wealth Management

Identify and onboard more customers quickly, in real time, with nominal to no friction. Protect your customer assets against sophisticated account takeovers with advanced fraud detection and authentication solutions.

As more and more banking is happening digitally, financial institutions need to find ways to go branchless and accelerate their digital transformation efforts.

Decrease account origination drop-off rates by up to 40% with a process that is easy on users and tough on fraud.

Jumio enables real-time ID and identity verification to enhance your security profile and verify a user is who they say they are.

Jumio includes face-based biometrics powered by informed AI to deliver a robust, multi-pronged approach to KYC/AML.