Frictionless services that stop fraudsters at the door and help you assess risk during onboarding and beyond.

How it Works

Try Our Demo App

How it Works

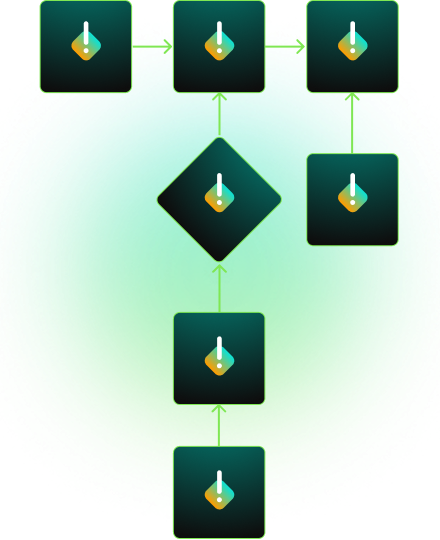

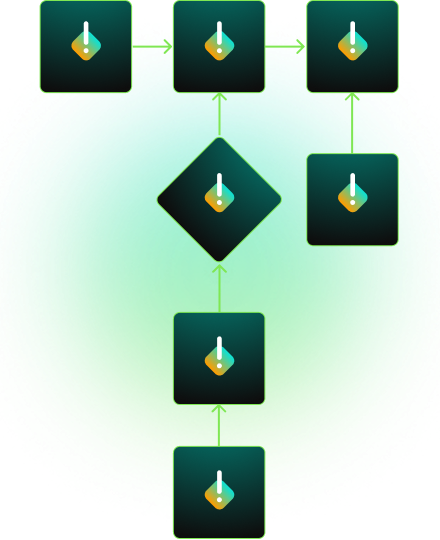

Customize

Use our customizable risk workflows to select the right amount of friction at the right time, starting with background signals like Device Risk and only triggering additional checks as needed.

1

Automate

For onboarding, automation enables easy decision making in real time based on the customer’s risk score.

2

Monitor

Keep your business healthy by periodically checking risk signals for your existing customers.

3

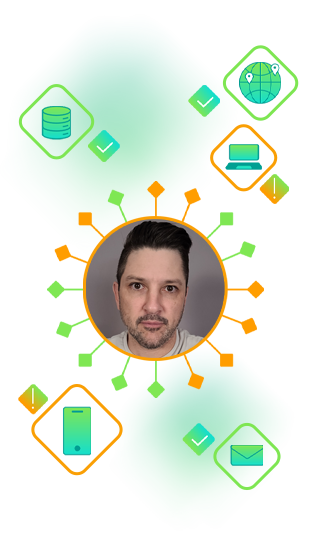

Comprehensive Data Hub

Access 500+ data sources to confirm your customers’ personally identifiable information (PII) and assess their risk.

Composite Risk Score

Get a yes/no answer, automatically drive onboarding decisions and streamline your workflows.

Ready to see how Jumio can help you better assess risk?

Key Services

Geo IP Check

Check the risk and reputation of the user’s IP address and determine their ISP’s location. This service is especially useful for stopping the user journey before it starts if the user is attempting to hide their actual location or if their IP address has unusually high velocity that can be attributed to a bot.

Device Check

Assess the risk of the user’s device with this frictionless check. Find out if they’re using GPS emulation, device rooting or proxies to mask their location and trick your online identification flow. Examines indicators such as extensive device history, fingerprinting anomalies, usage patterns and emulators.

Phone Number Check

Determine the risk and reputation of a phone number (landlines and mobile). This service looks at usage patterns, usage velocity and phone data attributes. It also checks the number against the Global Phone Data Consortium for fraud history and evaluates messaging behavior.

Email Check

More deeply assess the risk of an email address by evaluating its velocity, age, domain details, country, fraud history and other details.

Address Checks

Validate and corroborate addresses with independent, third-party sources. Determine whether the address extracted from a government-issued ID exists in the real world, and see if the person being verified actually lives at the address on their ID.

Learn more about Address Checks

Government Database Checks

Verify that the data provided by the user or extracted from the ID card matches the data held by the jurisdiction that issued the legal document.

Learn more about Government Database Checks

Social Security Number Check

For U.S. users, verify that their name and address (and optionally their date of birth and phone number) match the Social Security number by checking databases such as the Social Security Administration, USPS, credit bureaus and other proprietary sources.

Assurance at every step of the journey.

FAQs

AML regulations require businesses to take a risk-based approach to onboarding. This means your risk management solution must go beyond simply identifying the person’s identity — you must truly know your customer and their operational risk to your business. Therefore, risk identification is as important as identity verification in the KYC process. Risk signals combine metrics into a single risk score, which allows you to get a clear picture of the potential risks of your customers before you onboard them — and throughout the customer lifecycle.

The risk score is calculated based on many factors, including the age and reputation of the email address and phone number, the IP address of the device, and whether the person actually lives at the address on the ID. The result is a single score in one management system that helps reduce the risk associated with onboarding users online.

Yes, Jumio uses bank-grade security in all our products and services and utilizes proven internal controls, including regular tests for vulnerabilities and security risks. We are proud to have achieved ISO/IEC 27001:2013, PCI DSS and SOC2 Type 2 certifications, and our security is in a continuous process of improvement regardless of certifications that we hold or strive to achieve. For more information, see Information Security.

There are many enterprise risk management software solutions available, but the seamless integration of Jumio’s hundreds of risk signals with the identity verification process allows you to check the person’s identity and assess their risk in a single step. With only one contract to sign, one set of pricing, and one cloud-based platform to implement through a single API, business operations are all streamlined. Our analytics dashboards provide easy visualization of trends during internal audits and day-to-day use, allowing your incident management team and other stakeholders to prioritize and execute the right risk mitigation strategies in real time, maximizing business continuity and reducing the need for remediation. And our user-friendly risk signals (such as the frictionless Device Risk service) help maintain high conversion rates while reducing financial risk, making them an essential part of an integrated risk management solution.

There are many types of risk management platforms for everything from cyber risk to operational risk management to IT risk. But for deterring fraud, the best risk management software is cloud-based, easy to integrate with your existing user journey, and includes modules for verifying the person’s identity, screening them against watchlists including sanctions, politically exposed persons (PEPs) and adverse media, and re-authenticating their identity each time they sign in to your service online. See the related services below for more information.