Spanish Version

Portuguese Version

Latin America has fully embraced the digital revolution. In 2022, 74% of the population made online purchases, up from 55% only two years prior. And digital verticals such as gaming, ride hailing and advertising are experiencing phenomenal growth.

Unfortunately, fraud is also on the rise in LATAM, and companies are scrambling to implement the right cybersecurity measures.

The following infographic highlights the key issues LATAM companies face to ensure they keep fraudsters out while providing a great experience for their legitimate customers.

Text Version of Infographic:

Fraud and UX in LATAM

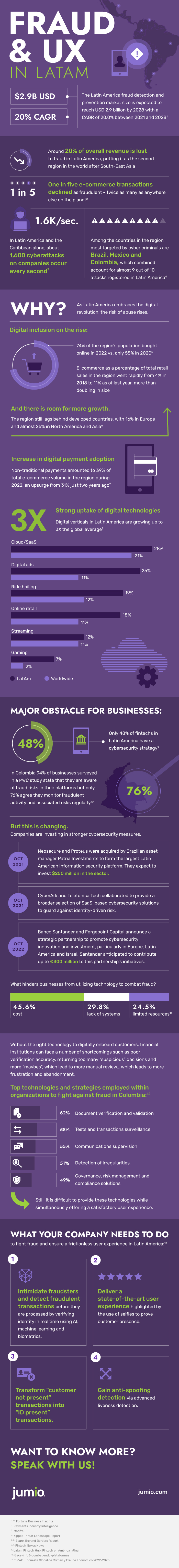

The Latin America fraud detection and prevention market size is expected to reach USD 2.9 billion by 2028 with a CAGR of 20.0% between 2021 and 2028

- Around 20% of overall revenue is lost to fraud in Latin America, putting it as the second region in the world after South-East Asia

- One in five e-commerce transactions declined as fraudulent – twice as many as anywhere else on the planet

- In Latin America and the Caribbean alone, about 1,600 cyberattacks on companies occur every second

- Among the countries in the region most targeted by cyber criminals are Brazil, Mexico, and Colombia, which combined account for almost 9 out of 10 attacks registered in Latin America.

Why? As Latin America embraces the digital revolution, the risk of abuse rises.

Digital inclusion on the rise:

Ecommerce volumes are ascending

- 74% of the region’s population bought online in 2022 vs. only 55% in 2020.

- E-commerce as a percentage of total retail sales in the region went rapidly from 4% in 2018 to 11% as of last year, more than doubling in size.

And there is room for more growth … The region still lags behind developed countries, with 16% in Europe and almost 25% in North America and Asia.

Increase in digital payment adoption: Non-traditional payments amounted to 39% of total e-commerce volume in the region during 2022, an upsurge from 31% just two years ago

Strong uptake of digital technologies: Digital verticals in Latin America are growing up to 3X the global average

- Cloud/Saas 28% LATAM 21% Global

- Digital ads 25% LATAM 11% Global

- Ride hailing 19% LATAM 12% Global

- Online retail 18% LATAM 11% Global

- Streaming 12% LATAM 11% Global

- Gaming 7% LATAM 2% Global

Major obstacle for businesses:

- Only 48% of fintechs in Latin America have a cybersecurity strategy.

- In Colombia 94% of businesses surveyed in a PWC study state that they are aware of fraud risks in their platforms but only 76% agree they monitor fraudulent activity and associated risks regularly.

But this is changing. Companies are investing in stronger cybersecurity measures. Example of investments:

- October 2021 – Neosecure and Proteus were acquired by Brazilian asset manager Patria Investments to form the largest Latin American information security platform. They expect to invest $250 million in the sector.

- October 2021 – CyberArk and Telefónica Tech collaborated to provide a broader selection of SaaS-based cybersecurity solutions to guard against identity-driven risk.

- October 2022 – Banco Santander and Forgepoint Capital announce a strategic partnership to promote cybersecurity innovation and investment, particularly in Europe, Latin America and Israel. Santander anticipated to contribute up to €300 million to this partnership’s initiatives.

What hinders businesses from utilizing technology to combat fraud? 45.6% cost, 29.8% lack of systems, 24.5% limited resources.

Without the right technology to digitally onboard customers, financial institutions can face a number of shortcomings such as poor verification accuracy, returning too many “suspicious” decisions and more “maybes”, which lead to more manual review … which leads to more frustration and abandonment.

Top technologies and strategies employed within organizations to fight against fraud in Colombia:

- 62% Document verification and validation

- 58% Tests and transactions surveillance

- 55% Communications supervision

- 51% Detection of irregularities

- 49% Governance, risk management and compliance solutions

Still, it is difficult to provide these technologies while simultaneously offering a satisfactory user experience.

What your company needs to do to fight fraud and ensure a frictionless user experience in Latin America:

- Intimidate fraudsters and detect fraudulent transactions before they are processed by verifying identity in real time using AI, machine learning and biometrics.

- Deliver a state-of-the-art user experience highlighted by the use of selfies to prove customer presence.

- Transform “customer not present” transactions into “ID present” transactions.

- Gain anti-spoofing detection via advanced liveness detection.

Want to know more? Speak with us!