Filter by

Most Recent

- Most Recent

- Most popular

All time

- All time

- This Month

- This Year

Overcoming the Coronavirus Impact on Compliance Teams

Update: The Beam platform is now Jumio Transaction Monitoring. *** Recently, we published a short, anonymous survey to research the impact of the coronavirus on compliance teams. Sadly, 100% of respondents said that the pandemic has impacted their ability to carry out their day-to-day tasks. And over 80% of respondents said that they’ve experienced slower case…

Sponsor Banks Are Responsible for Fintech Compliance

Although fintechs process financial transactions as part of their service offerings, most of them are not banks. Instead, they partner with a sponsor bank who moves the actual money between parties. This approach allows the fintech to focus on what they do best without having to jump through hoops to become an official bank. However,…

Money Laundering in Ozark: Fact or Fiction?

WARNING: This article contains spoilers about seasons 1 and 2 of Ozark. The Netflix original series Ozark dramatically depicts the life of Marty Byrde, a financial advisor who slips deeper and deeper into the world of money laundering for a Mexican drug cartel. The first two seasons of the show had a fantastic story and were incredibly well produced. Season…

COVID-19: A Call for Digital Transformation

The COVID-19 outbreak is a tragedy that will have widespread and long-lasting implications for humanity and our global economy. As the coronavirus continues to spread around the world, more and more enterprises will miss their financial targets because of supply chain disruptions and dampened customer demand. It’s also unclear how long this pandemic will last,…

Rethinking eKYC for Digital Banking in Asia-Pacific

In recent years, we have witnessed accelerated growth in Asia’s digital banking sector. More fintechs and newly licensed virtual banks are coming to market to address the unbanked segment, while traditional banks are transforming to manage costs and achieve operational efficiency in this increasingly competitive landscape. However, digitization has also exposed businesses to new risks,…

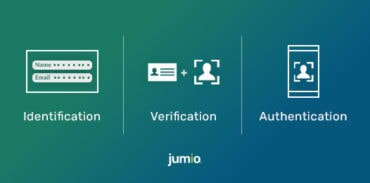

Identification vs. Verification vs. Authentication vs. Authorization: Comparing Definitions & Key Differences

Data breaches, compliance mandates, and identity theft have made it increasingly difficult for organizations and individuals to establish trust online. Yet, for those very same reasons, it’s more important than ever. From the baseline identification of a customer or user to the recurring authentication process of ensuring that the person logging into or using your…

![10 Tips to Convert More Customers During Account Onboarding [Infographic]](https://www.jumio.com/app/uploads/2020/02/Convert-More-Customers-Infographic-Social-370x183.png)

10 Tips to Convert More Customers During Account Onboarding [Infographic]

The digital onboarding journey is in need of a serious shake-up. While 72% of consumers want an all-digital onboarding experience, they’re clearly not happy with the current state of affairs — 56% of online bank account applications in the UK were abandoned due to a long or complicated enrollment process. There are a number of…

Why States’ Unclaimed Property Websites are Becoming a Lucrative Target for Fraud

There are literally billions of dollars — somewhere between $40 billion and $50 billion — of unclaimed property held by states. Each year, unclaimed or abandoned assets are turned over to each state’s Unclaimed Property divisions by financial institutions and businesses that lose contact with the owners of those assets. Each state’s treasury department serves…

Regtech: What It Is and What It Means for the Future of Financial Technology

What is regtech? Regulatory Technology is an emerging field that applies new technologies to manage the administration of regulatory requirements, and is considered a subset of fintech (technologies that make financial activities more efficient). Here’s how John Dwyer, senior research analyst at Celent, explains the growth of regtech. “By harnessing technology to improve and optimize…

How Jumio Uses AI for Automatic Recognition of ID Documents

Jumio recently announced the beta launch of Jumio Go, a fully automated identity verification solution. Jumio Go combines AI, OCR and certified liveness detection technologies to automatically extract ID document data and validate the user’s digital identity in real time. Jumio Go, along with Jumio’s entire suite of identity verification and authentication solutions, automatically performs…

Why KYC Is Essential to Security for Banking Institutions

The Hudson United Bank of New Jersey was one of the banks used by the airplane hijackers who perpetrated the deadliest attack ever on American soil on Sept. 11, 2001. According to the 9/11 Commission, money-laundering safeguards within the financial industry at the time were not designed to detect or disrupt the type of deposits,…

How Jumio’s Investment in AI is Delivering Big Results for Our Customers

Today we’re excited to announce some big improvements in our industry-leading identity verification and authentication solutions. Made possible by our multi-year investment in AI, automation and product development, these innovations are onboard now to help you fight fraud and meet your compliance requirements, while converting good customers faster. We invite you to get the complete…