New research from Jumio also reveals consumers continue to overestimate their ability to spot deepfakes and want governments to do more to regulate AI

Jumio, the leading provider of automated, AI-driven identity verification, risk signals and compliance solutions, today released the Jumio 2024 Online Identity Study, the third installment of its annual global consumer research. This year’s results highlight significant concerns among consumers about the risks associated with generative AI and deepfakes, including the potential for increased cybercrime and identity fraud.

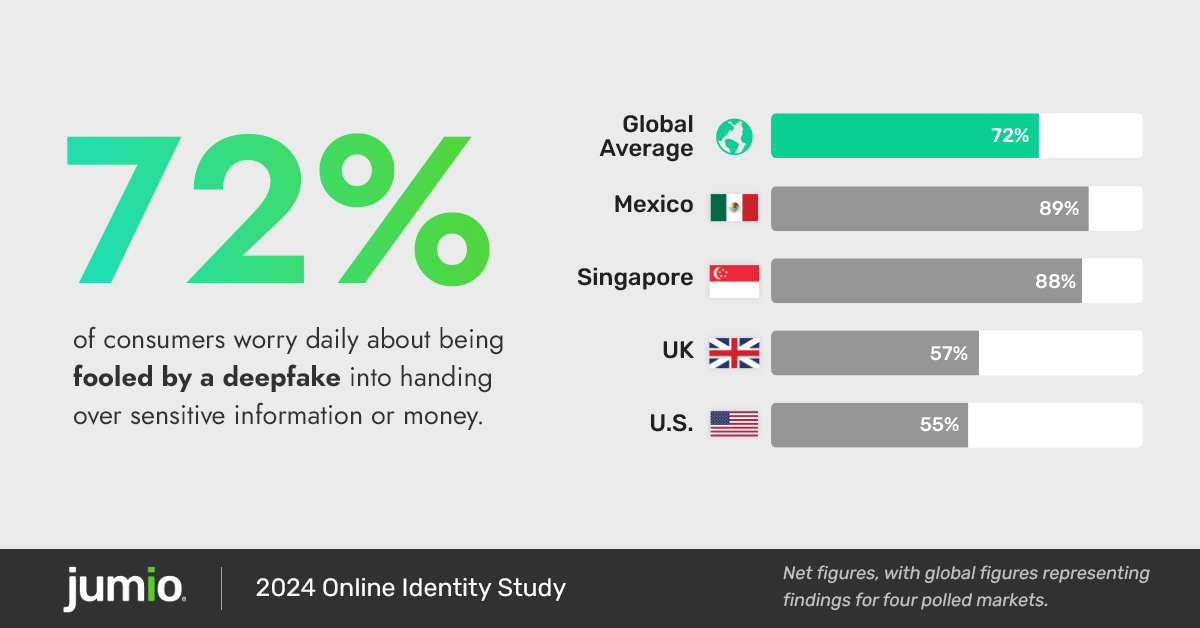

The study examined the views of more than 8,000 adult consumers, split evenly across the United Kingdom, United States, Singapore and Mexico. The results suggest nearly three-quarters of consumers (72%) worry on a day-to-day basis about being fooled by a deepfake into handing over sensitive information or money. Only 15% of consumers said they’ve never encountered a deepfake video, audio or image before, while 60% have encountered a deepfake within the past year.

Even with high anxiety around this increasingly prevalent and ever-evolving technology, consumers continue to overestimate their own ability to spot deepfakes — 60% believe they could detect a deepfake, up from 52% in 2023. Men were more confident in their ability to spot a deepfake (66% men versus 55% women), with men aged 18-34 demonstrating the most confidence (75%), while women aged 35-54 were least confident (52%).

“As generative AI advances, the incidence of deepfakes continues to rise, revealing a significant gap in our collective ability to detect these deceptions,” said Stuart Wells, Jumio’s chief technology officer. “This continued overconfidence underscores the critical need for stronger public education and more effective technological solutions. It’s essential that businesses and consumers collaborate to enhance digital security measures to effectively prevent identity fraud.”

A significant majority (60%) of consumers call for more governmental regulation of AI to address these issues. However, regulatory trust varies globally, with 69% of Singaporeans expressing trust in their government’s ability to regulate AI, compared to just 26% in the UK, 31% in the U.S. and 44% in Mexico.

The true cost of online fraud

Fraud is an all-too-familiar issue for many consumers across the globe, with 68% of respondents reporting that they know or suspect that they’ve been a victim of online fraud or identity theft, or that they know someone who has been affected. U.S. consumers were most likely to be direct victims of fraud (39%) either knowingly or by suspicion, and Singapore was the top country to report knowing a victim (51%).

While nearly half (46%) of the consumers who were or suspected they were a victim of online fraud or identity theft said the ordeal was a minor inconvenience, 32% said it caused significant problems and several hours of administrative work to resolve, and 14% went as far as calling it a traumatic experience.

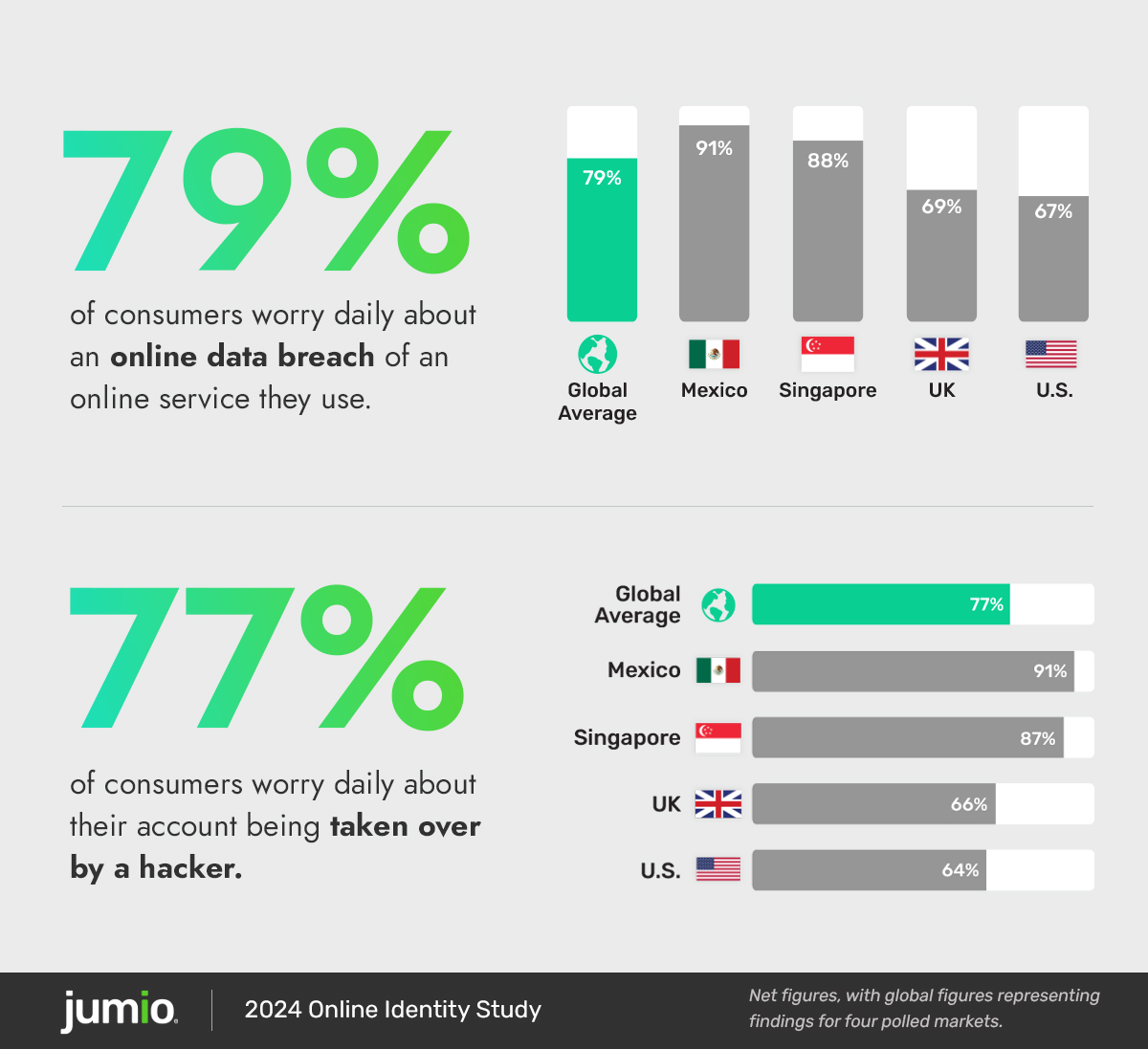

Regardless of whether they’ve been a victim of fraud or identity theft, most consumers worry daily about falling victim to data breaches (79%) and account takeover attacks (77%).

Balancing security and user experience for identity verification

Identity verification is a key part of the solution for companies looking to secure themselves and ensure that their users are genuine. More than 70% of consumers said they’d spend more time on identity verification if those measures improved security in industries including financial services (77%), healthcare (74%), government (72%), retail and ecommerce (72%), social media (71%), the sharing economy (71%), and travel and hospitality (71%).

When creating a new online account, global consumers said taking a picture of their ID and a live selfie would be the most accurate form of identity verification (21%), with creating a secure password coming in at a close second (19%).

“As we navigate the complexities introduced by generative AI, the role of sophisticated security systems becomes crucial,” said Philipp Pointner, Jumio’s chief of digital identity. “To counter the rise in deepfakes and cyber deception, incorporating multimodal, biometric-based verification systems is imperative. These technologies are key to ensuring that businesses can protect their platforms and their customers from emerging online threats, and are significantly stronger than passwords and other traditional, outdated methods of identification and authentication.”

Find additional data and insights here.

The research was conducted by Censuswide, with 8,077 consumers split evenly across the United Kingdom, United States, Singapore and Mexico. The fieldwork took place between March 25 and April 2, 2024. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct which is based on the ESOMAR principles and are members of The British Polling Council.

About Jumio

Jumio helps organizations to know and trust their customers online. From account opening to ongoing monitoring, the Jumio platform provides advanced identity verification, risk signals and compliance solutions that help you accurately establish, maintain and reassert trust.

Leveraging powerful technology including automation, biometrics, AI/machine learning, liveness detection and no-code orchestration with hundreds of data sources, Jumio helps you fight fraud and financial crime, onboard good customers faster and meet regulatory compliance including KYC and AML. Jumio has processed more than 1 billion transactions spanning over 200 countries and territories from real-time web and mobile transactions. Based in Sunnyvale, Jumio operates globally with offices and representation in North America, Latin America, Europe, Asia Pacific and the Middle East and has been the recipient of numerous awards for innovation. Jumio is backed by Centana Growth Partners, Great Hill Partners and Millennium Technology Value Partners.

For more information, please visit www.jumio.com.

Contacts

U.S. Media Contact

Allison Knight

10Fold Communications

[email protected]

806-570-9819

Europe Media Contact

Harriet King

FleishmanHillard UK

[email protected]

+44 7765673794

APAC Media Contact

Luke Nazir

FINN Partners

[email protected]

+65 8139 2504