Know and trust that your customers are who they say they are. Jumio automates the online identity verification process to help prevent online identity fraud and identity theft, and simplify KYC/AML compliance while providing a frictionless onboarding experience.

Identity Verification Services

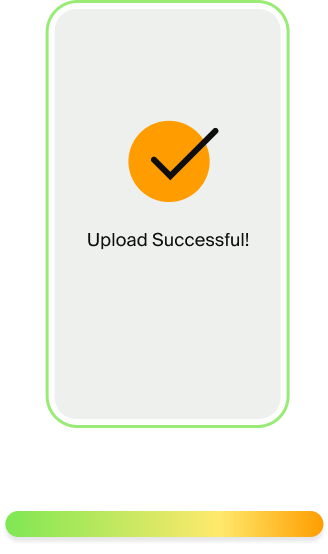

Securely onboard new customers in seconds with industry-leading technology and a smooth UX.

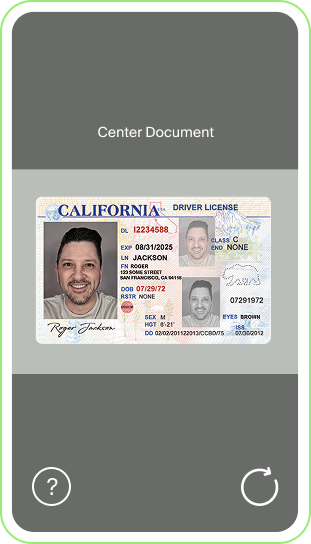

Try Our Demo App

Securely onboard new customers in seconds with industry-leading technology and a smooth UX.

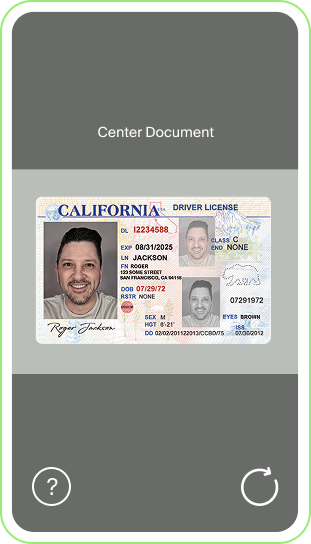

ID Check

Is the identity document (ID) authentic and valid?

1

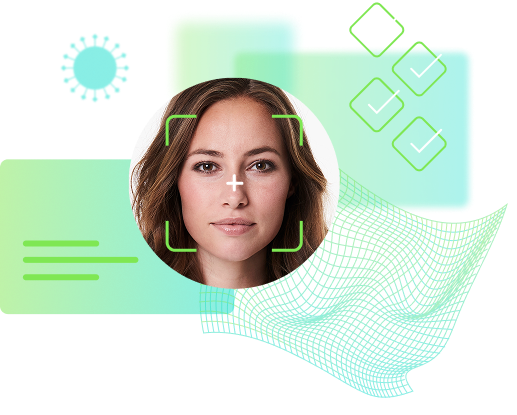

Selfie

Jumio's selfie + liveness check process verifies: Is the person holding the ID the same person shown in the ID photo? Are they physically present during the transaction? Is this a real person, not a spoof?

2

Decision

For a risk-based decision, Jumio calculates the fraud risk and approves or rejects the identity transaction in seconds based on your predefined risk tolerances.

3

Ready to see how Jumio can help you build digital trust?

Solution Highlights

Automatically Verify IDs

Ensure secure ID document authentication by checking against known ID templates to ensure that all the requisite security checks (e.g., holograms, watermarks, font types, etc.) are present.

Fraud Deterrence

Subjects users to a brief liveness check, which serves as a powerful fraud deterrent for many scammers who prefer not to share their own likeness with the company they're looking to defraud.

User Experience

Dramatically reduce user friction and verification time while increasing conversion rates.

Advanced Liveness Check

Perform liveness detection using advanced face-based biometric technology for spoof-proofing.

Course Correction

Reduce abandonment rates by enabling your users to retake a picture of their ID or selfie if the initial image is unreadable.

Compliance

Comply with KYC, AML, CCPA, GDPR and many more privacy and financial services regulations and directives.

Security

All data is transmitted and stored with strong AES 256-bit encryption. Jumio is PCI-DSS Level 1 compliant.

By adding Jumio into the customer verification process, we are making life quicker and easier for our customers, minimising fall-out from lengthy verification processes and removing costly man hours where we have to receive and review documents manually."

Assurance at every step of the journey.

FAQs

Generally, users can use the same documents for digital identity verification that they would use to verify their identity in person. Some of the most common ID document verifications include:

- Driver’s License

- Passport or Passport Card

- State ID Card

- Permanent Resident Card

Identity verification is a key part of the account opening process and is commonly used by financial institutions to mitigate fraud risks. It can also be used to prevent minors from accessing age-restricted products. Furthermore, any company that wants to protect sensitive user data, including healthcare records and social media accounts, can use identity verification for both onboarding and for biometric authentication of returning users.