The Situation

In October 2019, the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) updated its Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) guidance on how to perform remote ID and identity verification. Updates to Canada’s anti-money laundering and anti-terrorist funding regulations now make customer onboarding and compliance much easier for banks and fintechs.

Who is Impacted?

The PCMLTFA is legislation directed at the detection of money laundering and terrorist financing through its registration and reporting requirements for “reporting entities,” including financial institutions, accountants, casinos, dealers in precious metals and stones, money service businesses, securities dealers and life insurance companies, brokers and agents.

More Ways Jumio Can Support You

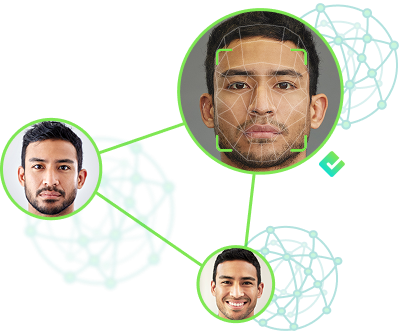

With Jumio, banks can streamline the onboarding process with an identity verification process that takes seconds. This translates to less online abandonment, fewer manual reviews and less hassle for your end users.

Ready to see how Jumio can help you achieve compliance?

Trusted by leading brands worldwide.

Erik Asbjørn Arvid Chief Technology Officer, :Dribe