About FINMA and AML

In 2016, the Swiss Financial Market Supervisory Authority (FINMA) started allowing Swiss-based financial institutions to use online identity verification to fulfill Swiss Anti-Money Laundering Act due diligence requirements. This means customers could be verified remotely and no longer needed to visit a local branch in order to open an account.

The Opportunity

Unfortunately, only a handful of top Swiss banks offer any sort of digital onboarding for new customers, and in most cases this is done through a cumbersome video chat process. The opportunity exists to turn digital onboarding into something that is both compliant and efficient.

How Jumio Can Help

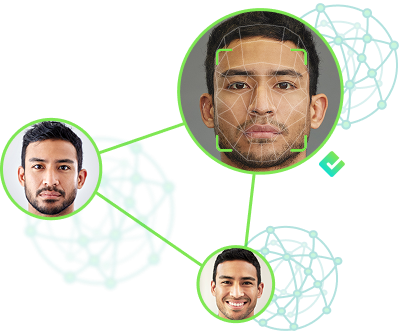

Updated FINMA regulations, which took effect in January 2020, include more stringent requirements aimed at making online identity verification even more secure. Jumio’s state-of-the-art identity verification technologies support FINMA regulations while also helping Swiss banks and financial institutions dramatically increase conversions and lower abandonment rates.

Ready to see how Jumio can help you achieve FINMA compliance?

Trusted by leading brands worldwide.

Jason Harper, Vice President of Product, Paysafe