Jumio Case Study – Personal Pay

Personal Pay safeguards its digital ecosystem with Jumio

Jumio Go provides real-time, friction-free identity verification powered exclusively by AI

Personal Pay is the virtual wallet of Telecom Argentina, a company that offers its customers a comprehensive experience through an ecosystem of digital services and solutions, based on connectivity, so that people, companies and communities can grow and move forward, but also enjoy, entertain and connect with whatever they want.

A company in constant evolution, Telecom Argentina made the commitment to contribute to financial inclusion and with this focus, began to develop Personal Pay at the end of 2019. Officially launched in 2022, the digital platform allows Argentines to pay, save, invest and manage money, efficiently and safely.

Through Personal Pay accounts, users can generate daily earnings, recharge their cell phone, access an international prepaid card, recharge their transportation cards and pay for services, send and receive money through a QR code and access a wide range of discounts and benefits. Additionally, people can use charging solutions for businesses.

The Personal Pay team wanted to integrate an online identity verification solution to make onboarding as quick and easy as possible for new users. They had four key criteria when considering solution providers: accuracy, efficiency, scalability and cost.

How Jumio Helps

“Jumio was a key ally from the beginning of the development of our platform, and provided a robust solution to ensure the security of our operations,” Balatti said.

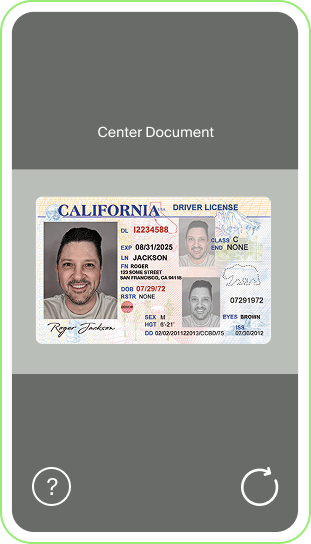

By using Jumio Go, Personal Pay is able to deliver a fully automated and friction-free onboarding process while deterring fraud and meeting compliance mandates. New customers only need to take a picture of their government-issued ID and a corroborating selfie. Jumio Go leverages the power of AI and machine learning to determine whether the ID document is authentic and verifies that the person pictured in the selfie matches the picture on the ID. It provides a definitive, risk-based decision in seconds, ensuring a user-friendly experience.

“At Personal Pay, our principle is to work with suppliers that maintain the same level of excellence that we consider for our operations. Meeting the demands of our company, Jumio was selected.”

Jumio offers the most mature verification solutions for the LATAM market, accepting and reliably verifying multiple types of government-issued IDs including passports, driver’s licenses and ID cards. In total, Jumio supports more than 5,000 ID subtypes around the globe, which will help Personal Pay as it expands into new markets.

More than 3 million clients now use Personal Pay to manage money in their daily economic actions after being vetted by Jumio Go during the onboarding process.

“Since its launch, Personal Pay has experienced sustained growth, which has even gone through stages with exponential peaks,” Balatti said. “On this journey, together with Jumio, we have been able to successfully process the data of the onboarded people, allowing the business to scale with a frictionless experience.”

How It Works

Try Our Demo App

How It Works

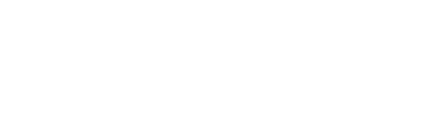

ID Check

Is the identity document (ID) authentic and valid?

Selfie

Jumio's selfie + liveness check process verifies: Is the person holding the ID the same person shown in the ID photo? Are they physically present during the transaction? Is this a real person, not a spoof?

Decision

For a risk-based decision, Jumio calculates the fraud risk and approves or rejects the identity transaction in seconds based on your predefined risk tolerances.