Jumio Case Study

iCard Makes Payments Easier, Accessible and Secure with Jumio

Jumio Identity Verification simplifies and speeds up onboarding for Bulgarian fintech iCard while also defending against fraud

iCard’s mission is to make modern payment services accessible for everyone. Founded in 2007, the Bulgarian fintech has over a decade of experience delivering innovative payment services through the iCard app. One account lets customers send bank transfers, send free and instant transfers, pay with their phones, shop online with virtual cards and have access to their money anytime and anywhere. iCard accounts and cards are free of charge and don’t have monthly service fees.

While iCard customers have always been able to apply for an account online, earlier iterations of the onboarding process required a five-minute video chat. During the call, a trained iCard specialist would verify the customer’s identity by taking photos of their ID document and asking a series of questions.

iCard needed an automated solution that would enable them to verify customer identities in a matter of seconds while meeting KYC compliance mandates. They also wanted a vendor with international compatibility — more than 1.4 million customers in over 30 European countries use iCard’s services — and strong fraud prevention capabilities.

How Jumio Helps

Jumio has been iCard’s identity verification provider since 2018. “Jumio consistently delivers higher pass rates than we had before without compromising on speed or security,” said Gabriela Anastasova, iCard head of product definition. “This has helped us significantly to reduce the cost of manual review as we onboard more new users to our platform, safe in the knowledge that we remain compliant with regulatory requirements.”

Jumio consistently delivers higher pass rates than we had before without compromising on speed or security."

Jumio leverages the power of biometrics, AI and the latest technologies to quickly and automatically verify the digital identities of new iCard customers.

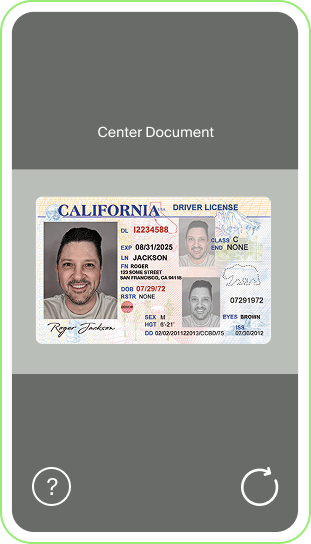

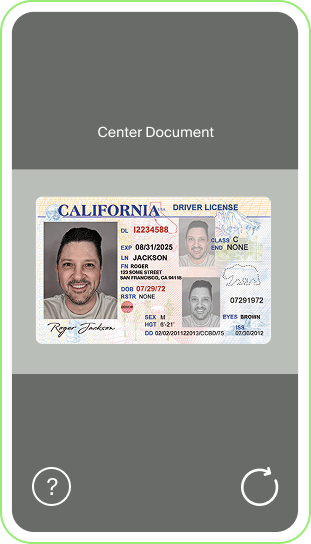

During the onboarding process, new customers take a picture of their government-issued ID and a corroborating selfie. Jumio determines if the ID document is authentic and that the person pictured in the selfie matches the picture on the ID, providing an accurate verification decision in a matter of seconds and ensuring a user-friendly experience.

Jumio offers the most comprehensive identity verification solutions on the market, accepting and reliably verifying more than 5,000 ID subtypes from around the globe, which will enable iCard to scale its onboarding process as it grows.

“Jumio gives us the ability to easily verify customers in all our markets with minimal effort,” Anastasova said. “It’s great that Jumio already supports a broad range of identity documents from different geographies so it’s simple for us to verify identities in all the countries we operate in, and even accept paper ID cards.”

Since integrating Jumio into its workflow, iCard has experienced a more streamlined and efficient KYC process, resulting in a 35% boost in conversions just in the first year.

How It Works

Try Our Demo App

How It Works

ID Check

Is the identity document (ID) authentic and valid?

Selfie

Jumio's selfie + liveness check process verifies: Is the person holding the ID the same person shown in the ID photo? Are they physically present during the transaction? Is this a real person, not a spoof?

Decision

For a risk-based decision, Jumio calculates the fraud risk and approves or rejects the identity transaction in seconds based on your predefined risk tolerances.