Jumio Case Study – DolarApp

DolarApp Breaking Down Borders with Jumio

LATAM finance startup uses Jumio Go to accelerate onboarding, meet compliance mandates and fight fraud

By providing digital dollar accounts for Latin Americans, DolarApp makes it possible for customers in the LATAM region to send and receive transfers locally and in the U.S., dollarize their savings in a legal way and pay with an international Mastercard in any currency at the best rates – both when they travel and when they use DolarApp for everyday expenses.

DolarApp’s three co-founders saw a need for access to banking in dollars in LATAM. When developing the app, the team sought out an automated solution that would help quickly and easily verify customer identities during the onboarding process while meeting KYC compliance mandates. They also wanted a vendor with international compatibility and strong fraud prevention capabilities.

How Jumio Helps

“DolarApp since day zero has been very conservative on the issue of fraud, which is why Jumio is our identity verification provider,” said Alvaro Correa, DolarApp co-founder and chief operating officer. “In fact, the first conversations we had with Jumio were before we even raised any funding rounds.”

All three of DolarApp’s co-founders and some of their engineers already knew about Jumio during their time working at Revolut, a Jumio customer since 2015.

When choosing an identity verification vendor, it was very important for us to work with a company with high quality standards, market coverage and scale.”

DolarApp has been a Jumio customer since 2021.

DolarApp began using Jumio Go in Mexico and later expanded into Argentina and Colombia. Jumio offers the most mature verification solutions for the LATAM market, accepting and reliably verifying multiple types of government-issued IDs including passports, driver’s licenses and ID cards.

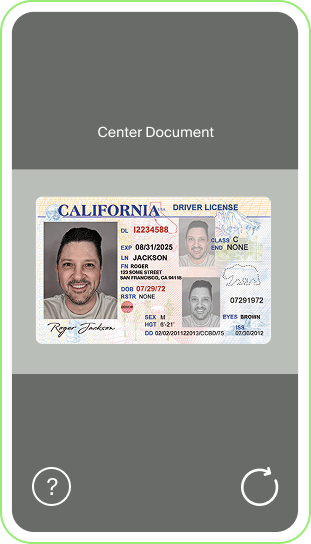

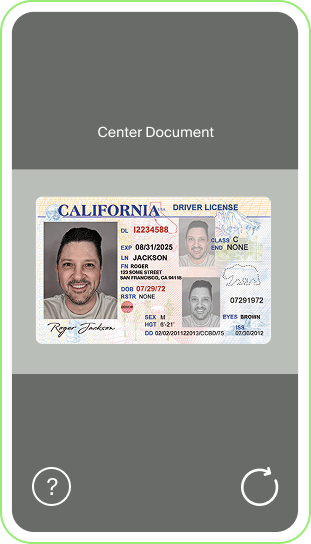

By using Jumio Go, DolarApp is able to deliver a fully automated and friction-free onboarding process. New customers only need to take a picture of their government-issued ID and a corroborating selfie. Jumio Go leverages the power of AI and machine learning to determine whether the ID document is authentic and verifies that the person pictured in the selfie matches the picture on the ID. It provides a definitive, risk-based yes-or-no verification decision in seconds, ensuring a user-friendly experience.

How It Works

Try Our Demo App

How It Works

ID Check

Is the identity document (ID) authentic and valid?

Selfie

Jumio's selfie + liveness check process verifies: Is the person holding the ID the same person shown in the ID photo? Are they physically present during the transaction? Is this a real person, not a spoof?

Decision

For a risk-based decision, Jumio calculates the fraud risk and approves or rejects the identity transaction in seconds based on your predefined risk tolerances.