Jumio Case Study – Banco BICE

Banco BICE Protects Client Accounts with Jumio

Jumio identity verification technology digitizes the password reset process without impacting the user experience

Banco BICE (Banco Industrial y de Comercio Exterior) is a Chilean bank that provides general banking and investment services such as deposits, credit accounts, lease financing and insurance services; manages mutual funds and investments, advises on mergers and acquisitions, privatizations and public offerings, and offers securities brokerage services.

Established in 1978, Banco BICE is headquartered in Santiago, Chile, and serves private, corporate and institutional clients in the country today.

While Banco BICE is one of Chile’s most established financial institutions, they’re constantly evolving to meet the needs of their clients and striving to offer an excellent quality of service. Gone are the days of walking into a bank branch to manage your finances – today’s banking customers want the flexibility to manage their accounts online.

When digitizing its banking operations, Banco BICE needed a way to protect customer accounts during the password reset process. Password resets used to be a manual process that required clients to either visit a bank branch or call their account executive.

We had two big problems: we needed a solution provider that would give us confidence that the person on the other side of the screen is who they say they are, and we also needed a process that would help us maintain high conversion rates.”

How Jumio Helps

Banco BICE had three main criteria when vetting identity verification vendors: they wanted someone with global coverage, strong fraud-fighting capabilities and a user-friendly solution to ensure customer satisfaction.

After evaluating multiple vendors, Banco BICE chose Jumio as its identity verification provider in 2021.

Jumio offers the most mature verification solution for the LATAM market, accepting and reliably verifying multiple types of government-issued IDs including passports, driver’s licenses and ID cards. In total, Jumio supports more than 5,000 ID subtypes from over 200 countries and territories around the globe.

Jumio’s identity verification solutions leverage the power of biometrics, AI and the latest technologies to quickly and automatically verify the digital identities of Banco BICE customers requesting password assistance.

With identity theft and online account takeovers on the rise, Banco BICE needed to make sure their new digital solution was very unattractive to fraudsters. Fortunately, Jumio’s advanced technology has been trained on the largest real-world data sets in the industry and has processed over 1 billion transactions, making it the leading identity verification solution. Just by requiring a valid, government-issued ID and a corroborating selfie, Jumio helps Banco BICE deter fraudsters who generally prefer not to share their own photo with the bank they’re trying to defraud.

Integration was straightforward, Barros said, and while Banco BICE initially chose Jumio for password resets, the solution will also help with new client onboarding in the future.

Since using Jumio, Banco BICE has been able to reduce the number of manual password resets by 50% – that’s thousands of phone calls no longer coming into the bank’s customer service team. This leads to much greater customer satisfaction as well as reducing the burden on the bank’s staff, creating a win-win situation for everyone.

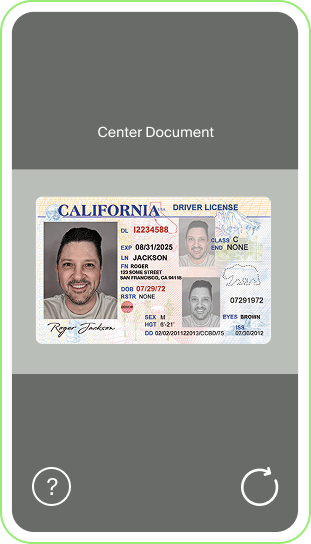

How Jumio Works

Try Our Demo App

How Jumio Works

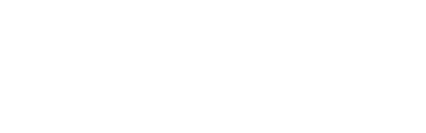

ID Check

Is the identity document (ID) authentic and valid?

Selfie

Jumio's selfie + liveness check process verifies: Is the person holding the ID the same person shown in the ID photo? Are they physically present during the transaction? Is this a real person, not a spoof?

Decision

For a risk-based decision, Jumio calculates the fraud risk and approves or rejects the identity transaction in seconds based on your predefined risk tolerances.