Filter by

Most Recent

- Most Recent

- Most popular

All time

- All time

- This Month

- This Year

Bank With Your Smile: How Jumio Helps Credit Unions Fight Fraud

Jumio is on a mission to help credit unions fight fraud. Many credit unions are worried about implementing a new system that might disrupt their current members’ experience. At the same time, they know they have to take a proactive approach to fighting fraud, because waiting too long could jeopardize their brand and ultimately lose…

The Changing Face of Identity Verification

As businesses continue to expand their online offerings — and fraudsters become more and more sophisticated — it’s essential to be able to quickly and accurately establish the real-world identity of each person. According to the 2023 Gartner® Market Guide for Identity Verification, “The purpose of identity verification is to establish confidence in the identity…

How Biometric Security is Changing the Healthcare Industry

Advanced technology has been transforming the healthcare industry for decades, and meaningful changes have been made in how patients receive care and communicate with care teams. But little attention was given to healthcare operations and data security, creating opportunities for fraud, data leaks and workflow inefficiencies. The latest in biometric security technology is changing that….

Fighting the Specter of Fraud in Higher Education

Halloween may be weeks away, but the ghosts are out early this year — ghost students, that is. Ghost students are bots created by fraudsters that take advantage of online college application systems in order to receive financial aid and grant money. Using stolen or synthetic identities, they apply at colleges, register for classes and…

Everything You Need to Know About Responsible Gaming — FAQs

From online casino games to sports betting and wagering apps, online gambling (gaming) is becoming increasingly popular throughout the U.S. and around the world. That’s why it’s more important than ever for gaming operators and players to understand responsible gaming and follow safer gambling practices to keep it fun and avoid harm. In honor of…

The Harsh Reality of Account Takeover Fraud and the Future of Prevention [Infographic]

Account takeover (ATO) fraud is when a bad actor seizes control of an online account, changes information such as the username, password or other personal information, and then makes unauthorized transactions with that account. ATO is on the rise, and businesses and banks are in the crosshairs. 2022 had the second-highest number of data compromises…

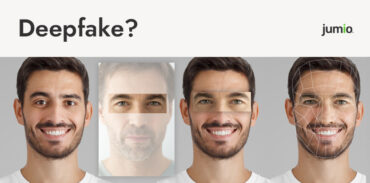

From Phishing to Deepfakes: Understanding the Evolving Landscape of Online Fraud

“Are you who you say you are?” This seemingly simple question, once reserved for the philosophical musings of great thinkers, has now found its way into the uncharted territories of the digital landscape. It’s no longer the scholars debating identity — it’s the online businesses desperate to discern the truth amidst the ever-looming threat of…

KYC: What “Know Your Customer” Means and Why It’s Important

Know Your Customer (KYC) refers to the process institutions use to verify the identities of their customers and ascertain what fraud risks they may pose. The premise is that knowing your customers — performing identity verification, reviewing their financial activities, and assessing their risk factors — can keep money laundering, terrorism financing and other types…

Fighting AI with AI: What Businesses Need to Know about Generative AI and Fraud

Generative artificial intelligence (AI) has caused a massive leap forward in technology. Tasks such as researching and writing reports as well as creating images can now be done in seconds instead of days or months. But while these automation tools can lead to vastly improved efficiencies for businesses, it is also ushering in a new…

What is Enhanced Due Diligence (EDD)?

In today’s business and regulatory climate, a business should not only be concerned with making profits — it should also attempt to know who it has business dealings with. This means identifying and verifying customers’ identities and meeting Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines. When a financial institution creates a new business…

3 Key Findings from Jumio’s 2023 Online Identity Consumer Study [Infographic]

Generative AI has captured the imagination of millions worldwide, largely driven by the recent success of ChatGPT, the text-generation chatbot. While there are many potential benefits when it comes to this technology, in the wrong hands it also serves as a powerful weapon for taking cybercrime to a whole new level through the creation of…

7 Most Common Types of Identity Theft and Fraud

The ability to conduct financial transactions online and share personal data provides huge benefits in terms of speed and availability of services that might not be possible otherwise. But this convenience can also come at a cost. Various types of identity theft and fraud are growing every year, thanks to data breaches and the ever-evolving…