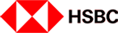

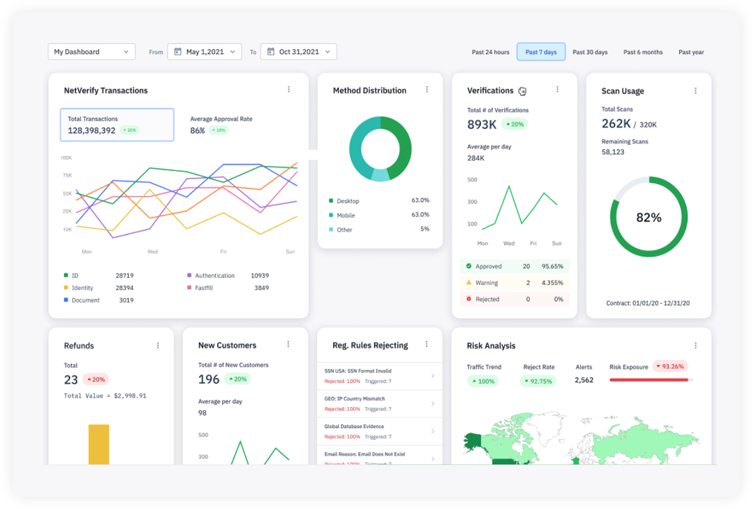

Whether reviewing real-time analytics, investigating transactions or updating rules, you can mitigate risk on your terms using our Unified Portal.

transactions processed

ID types in over 200 countries and territories

best-in-class global data sources

data scientists building cutting-edge Al and ML models

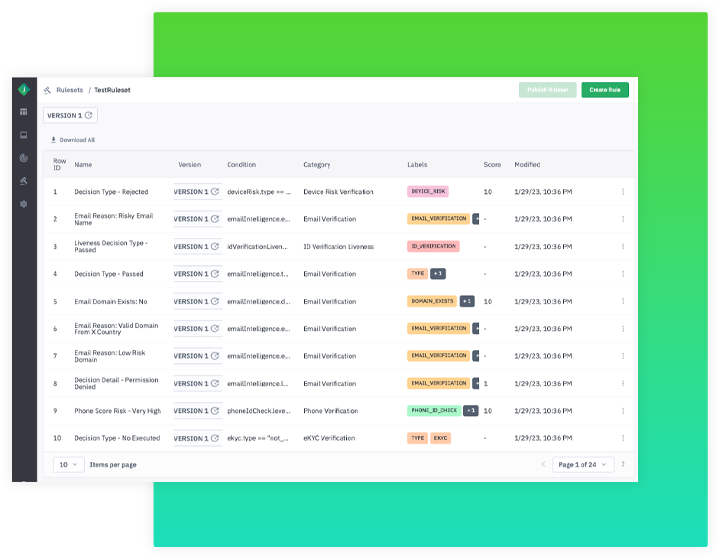

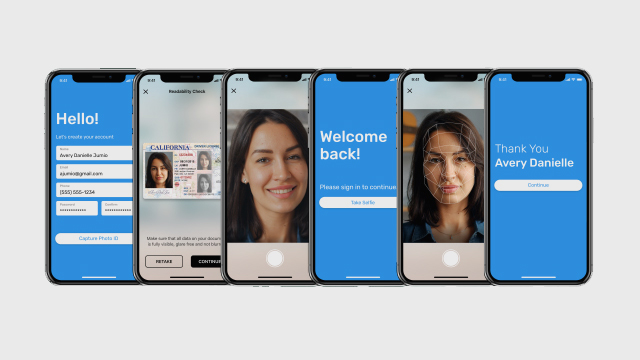

Verify identities and detect fraud throughout the customer lifecycle – from onboarding to ongoing monitoring.

Explore Identity Verification

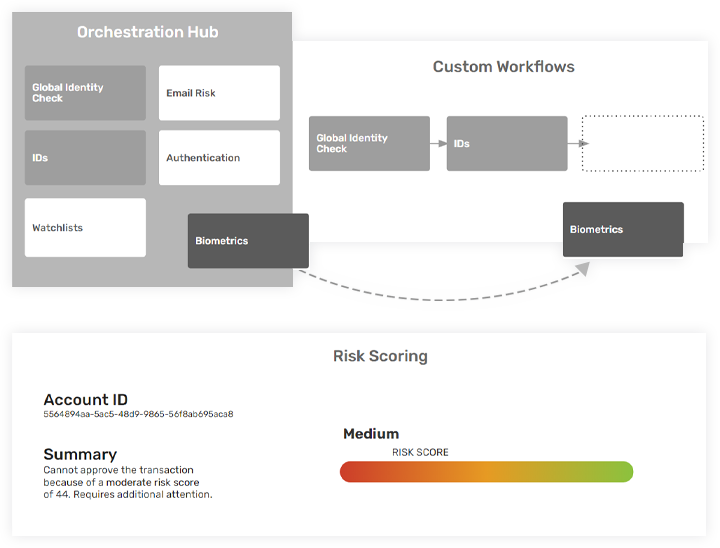

Gain predictive fraud insights and in-the-moment risk analysis based on past and present behavior data, along with recognized fraud patterns and risk signals.

Learn About Risk Signals

Deliver dynamic user experiences based on each customer’s verified identity and risk profile, allowing real customers to proceed without disruption.

See How It Works

Whether reviewing real-time analytics, investigating transactions or updating rules, you can mitigate risk on your terms using our Unified Portal.

This quick video shows how Jumio can help you:

"As Monzo continues to grow and pursue new markets, we know that Jumio will scale with our business and continue to provide an essential service – helping Monzo create the best-possible experience for our banking customers while fighting financial crime."

Head of Financial Crime, Monzo Bank

Read the Case Study